KCCCI Talk @ Berkeley Uptown

by paramount

by paramount

by paramount

June 15, 2019: As the volume of office space in the Klang Valley rises, competition in securing tenants has become more intense.

According to data from the National Property Information Centre (Napic), Kuala Lumpur office space totalled 8.89 million sq m in 2018, which saw the average occupancy rate drop to 79.7% from 80% in 2017.

Selangor also experienced a dip in office occupancy. The state recorded a 74.1% occupancy rate in 2018 for a total space of 3.75 million sq m compared with 75.5% in 2017.

Overall, Malaysia saw an addition of 250,938 sq m of office space in 2018, bringing the total volume of office space in the country to 21.84 million sq m. The occupancy rate in 2018 slipped slightly to 82.4% from 83.3% in 2017.

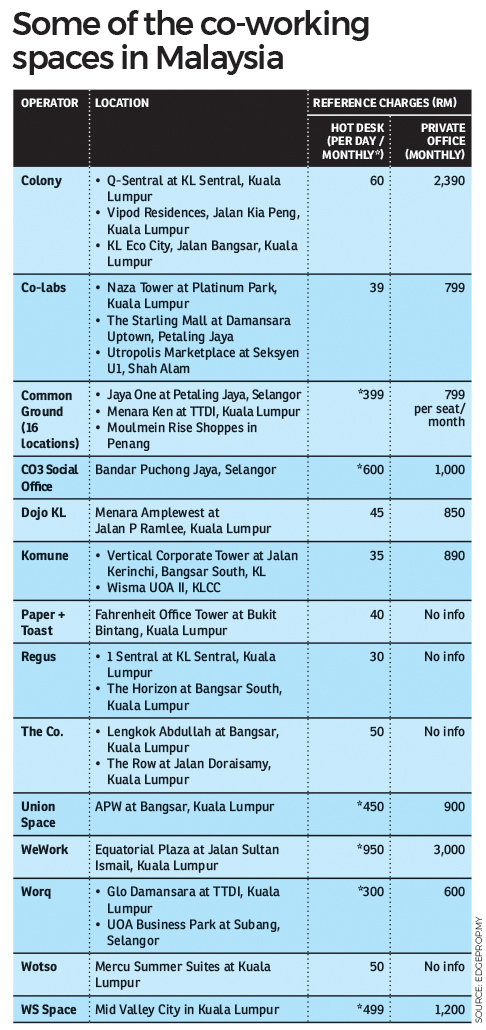

To attract tenants, newly completed office spaces are equipped with various modern lifestyle features, and with few takers from companies, many new office owners are turning their vacant spaces into co-working spaces.

Indeed, many conventional office owners or developers in Malaysia are creating co-working spaces in their developments either by venturing into the business and creating their own brand or through joint ventures with established service providers.

For instance, UEM Sunrise Bhd has partnered Australia-based Blackwall Ltd to bring in the first Wotso Workspace with a space of 14,000 sq ft to the developer’s Mercu Summer Suites commercial development on Jalan Cendana, Kuala Lumpur.

Wotso’s presence in Mercu Summer Suites not only helps to absorb a part of the office space in the commercial development but also helps to bring in the crowd to the office building, exposing it to more potential business opportunities.

Meanwhile, home-grown co-working space company Common Ground has partnered with Petronas Dagangan Bhd — the marketing arm of Petroliam Nasional Bhd (Petronas), to open a co-working space at The Place @ Ampang at Jalan Kolam Air Lama, Selangor.

Shopping malls with ample space and lifestyle elements are also ideal places for co-working spaces, considering the amenities available at their disposal, especially the retail outlets, F&B choices and car parks.

For instance, Paramount Corp Bhd, through its subsidiary Paramount Coworking Sdn Bhd, has taken up 20,000 sq ft on the fourth floor of Starling Mall in Damansara Uptown, Petaling Jaya, Selangor to house its Co-labs co-working space.

In August this year, Co-labs The Starling will add 15,000 sq ft on the same floor and the extension will be called Co-labs The Starling Plus, providing premium offerings.

Demand for flexibility

Nawawi Tie Leung Property Consultants Sdn Bhd director and head of valuation Daniel Ma observes that the demand for co-working space is on the rise in Malaysia, in line with the global trend in co-working space.

“They do not only cater to individuals or start-ups as there is a rising number of Malaysian corporations and multinational companies (MNCs) that are looking at setting up an office within co-working spaces,” he tells EdgeProp.my.

For instance, Malaysia’s largest snack company — Mamee Double Decker (M) Sdn Bhd will be moving its Kuala Lumpur office to new luxury co-working space by Colony called Colony@Mutiara Damansara in Petaling Jaya.

Besides, regional startup — Carsome Malaysia will also be moving its headquarters with 150 people to Colony@Mutiara Damansara.

The 19,000 sq ft Colony@Mutiara Damansara is located at the KYM Tower. It has secured 81% occupancy to date, prior to its expected opening this July.

Convenience and cost efficiency

According to Knight Frank Malaysia corporate services executive director Teh Young Khean, the three pull factors for companies to take up co-working spaces are: flexibility; hassle-free and cost efficiency.

The conventional way of setting up an office, Teh explains, requires long-term tenancies and renovations or fit-outs that incur cost even before the business operation starts.

Other considerations include the location of the space — whether it is easy for its staff to commute and meet up with clients; and facilities such as pantry, WIFI connection, printers and car parking space.

The flexible lease arrangement on a quarterly or yearly basis offered by co-work space providers also allow for less commitment and more flexibility for the client especially for start-ups who are uncertain if their business would work out.

This model also attracts companies that are expanding and need more office space for their project teams to be located in various places, adds Teh.

Another advantage of co-working spaces is that it could open doors to more business opportunities as those sharing the space may be from different businesses, allowing for networking to happen in ways they may not have before.

Rejuvenate older buildings

Innovation could work magic, if the owners of older buildings could tap into the current co-work space trend, they could create renewed vibrancy for their buildings, especially considering the current office space oversupply challenge.

Nawawi Tie Leung’s Ma says having a co-working space in an old building could breathe new life to the building as it could raise footfall to the place. It would be easier for the building owner to lease out the remaining spaces once traffic rises.

However, Ma believes that having co-work spaces in a previously vacant building would not be a viable solution for the owners in the long run because most co-working space operators would negotiate for a longer lease, preferably 10 to 15 years for a substantial net lettable area (NLA). In return, they would expect other freebies such as rent-free periods.

“If the rent-free period is rather long, the net rental in the long run would be compressed and the building owners might not be able to maximise their returns once the office market picks up,” he elaborates.

Knight Frank’s Teh opines that co-working spaces can offer hard-to-let properties an opportunity to reposition themselves.

“It can be seen as a symbiotic relationship – developers get to loosen their office inventory while tapping into a new market that include freelancers, small and medium enterprises, entrepreneurs and others,” he elaborates.

In terms of resolving the current office oversupply, Teh reckons that rather than leaving them empty, co-working or serviced office spaces can help ease the pressure as operators usually take up a minimum of one floor or more in a building.

“However, the challenge is whether the building owner is willing to invest in improving the facilities in the building to make it attractive to co-working space operators,” he says.

Success factors

For a co-working space to successfully rejuvenate an old office building, there must be some fundamental factors in place, such as location, facilities and proximity to amenities.

Co-work space users often go for locations that are close to their clients or in areas that make sense for their business strategy. For instance, oil and gas service providers prefer co-working spaces located within walking distance of Kuala Lumpur City Centre.

To stand out from others, Teh notes that co-working space operators could consider adding other features, such as in-house apps (smart booking system) and other amenities like a gymnasium, recreational facilities and shower room, to attract customers.

For SMEs, although there are cheaper options such as renting the upper floor of a shoplot as an office, Nawawi Tie Leung’s Ma notes that co-working spaces are attractive to SMEs as they offer added services such as a proper lobby and reception area with reception service.

“Lifts, round-the-clock security, maintenance of building services and regular cleaning of common areas also make co-working spaces attractive,” he adds.

Branding is also important as some companies, especially MNCs, as well-established co-working space operators with a global presence may also allow its members to access workspaces in various cities around the world.

The luxury workspace

As the co-working trend spreads, some space providers have carved a niche for themselves serving the premium market by introducing luxury co-working spaces for high net worth individuals.

To draw consumers away from conventional office spaces, niche players would provide value-added services such as the Google Home system, smart desks with wireless charging, motion sensors, minibars, access to a private gymnasium and pool and will have their interior luxuriously designed by interior designers, says Ma.

The luxury co-working space is similar to hotel-standard offerings while some offer ultra-luxurious workspaces targeting the rich and famous.

Ma cites Colony for example. Colony’s Jamestown Suite @ KL Eco City is the first of its kind workspace equipped with a fully-stocked mini bar, a lounge sofa set, a flat screen TV and even a personal butler service. The less than 300 sq ft workspace is for one person and the monthly rental starts from RM10,000.

“Co-working space or serviced office space operators are starting to look beyond simply providing a funky or functional space but they are looking at space as a service.

“With their aim being to attract medium to large clients as well, co-working spaces are moving towards the enterprise model or the Core and Flex model to attract different kinds of occupiers,” says Knight Frank’s Teh.

Flexible workspaces can increase speed to market

The latest Global Workspace Survey research by International Workplace Group plc (IWG), found that flexible workspaces increase speed to market and help businesses consolidate portfolios, ultimately causing a ripple effect across the economy from core businesses to supply chains.

Listed on the London Stock Exchange, IWG (formerly Regus) is a multinational serviced office and co-working space provider. Its Global Workspace Survey is based on the opinions of more than 15,000 business leaders across 80 countries. As high as 80% of respondents, when faced with two similar employment offers, said they would choose to turn down the one that did not offer flexible working.

“Many companies have been quick to realise the benefits of flexible working as it allows employees to work in huge numbers of locations around the world and improves productivity, job satisfaction, talent retention and business performance.

“Indeed, many employees now consider it to be the “new normal” when looking for the next step in their careers – the demand for flexible working is increasing year-on-year and is showing no signs of slowing,” said Vijayakumar.

Tangarasan, Country Head for IWG Malaysia, Brunei and Indonesia in a recent press statement.

This story first appeared in the EdgeProp.my pullout on June 14, 2019. You can access back issues here.

by paramount

by paramount

by paramount

KUALA LUMPUR (May 30, 2019): Paramount Corp Bhd is currently in talks with potential partners to venture into housing markets abroad in the next five years.

Paramount group chief executive officer Jeffrey Chew (pic) said his team is currently studying the residential property markets in Thailand, Vietnam, Australia and the Philippines, and aims to pursue one or two of these markets under its next five-year plan starting 2020.

“We do see the Malaysian property market in major urban centres getting fairly mature. So rightly said, the next step is to really look at potentially going out of the country … I think we are ready to go,” Chew told reporters after the group’s annual general meeting yesterday.

“We are conducting market research on a couple of cities, visiting the sites, learning about the markets, and talking to potential partners as well,” he said, adding that Paramount will likely collaborate with joint venture partners in line with the group’s asset-light business strategy.

Paramount is eyeing to achieve up to 30% sales contribution from its overseas property segment under its five-year plan, he said, under which the group plans to evolve its businesses via digitisation and overseas ventures. The group invests about RM10 million to RM20 million in digitisation annually.

“We are watching very closely how the Fourth Industrial Revolution affects our businesses, both education and property.

“For the next five years, while we are going out of the country (expanding beyond Malaysia), we are also moving in terms of the digital journey. I won’t say we are out of education, but we are moving our business towards more digitisation.”

He said the group is well-positioned and is keen to expand its K-12 education segment — comprising kindergarten, primary, and secondary education — regionally or globally, if there are opportunities for strategic partnerships.

As for its tertiary education segment, Chew said the group, having invested in open-learning recently, hopes it will ultimately be part of the digital platform that delivers tertiary or lifelong education certifications.

He noted that the tertiary education segment has accumulated RM73 million in losses to-date, mainly due to dwindling population and increased emigration, amid fierce competition due to excess market capacity.

On that note, Chew hopes the government will look at more public-private collaborations whereby existing private capacities can be used, instead of building new public universities, to meet demand for public tertiary courses such as the Malaysian matriculation programme.

Two more co-working centres in the pipeline

To ride the growth of the sharing economy, Chew said Paramount aims to launch two more co-working centres this year, which will cost it between RM2 million and RM4 million each. It has two such centres now.

“Co-working space could be a new business on its own. It is also a secondary defensive strategy against potential property offices that cannot be sold,” he said.

Maintaining FY19 sales target at RM1b

Despite challenges of a softer property market, Chew said Paramount is maintaining its RM1 billion sales target set for the financial year 2019 (FY19) ending Dec 31, 2019 as the group still has RM891 million worth of launches lined up for the remainder of the year.

The group anticipates the return of firmer demand from the second half of this year, when some of the unsold inventories in the market are absorbed.

“We did not have strong sales in 1QFY19 (first quarter of FY19) because the market was slow and we have not really launched many projects since 4QFY18.

“It is getting challenging but we still think that with the launches that are piling up, and as the economy starting to gain traction and confidence [from] the business community and foreign interests, we probably have a chance. We haven’t given up on the RM1 billion [target].”

Paramount’s remaining indicative launches this year include Bukit Banyan in Sg Petani, Kedah (RM153 million), Utropolis Batu Kawan in Penang (RM243 million), Greenwoods, Salak Perdana in Sepang (RM136 million), the remaining phases of Berkeley Uptown in Klang (RM114 million), Lakeside in Cyberjaya (RM132 million), as well as its SelangorKu affordable homes in Kemuning Utama (RM113 million).

© 2024 Paramount Property Development Sdn Bhd 200201020247 (587910-U)

· Privacy Notice · PDPA Notice