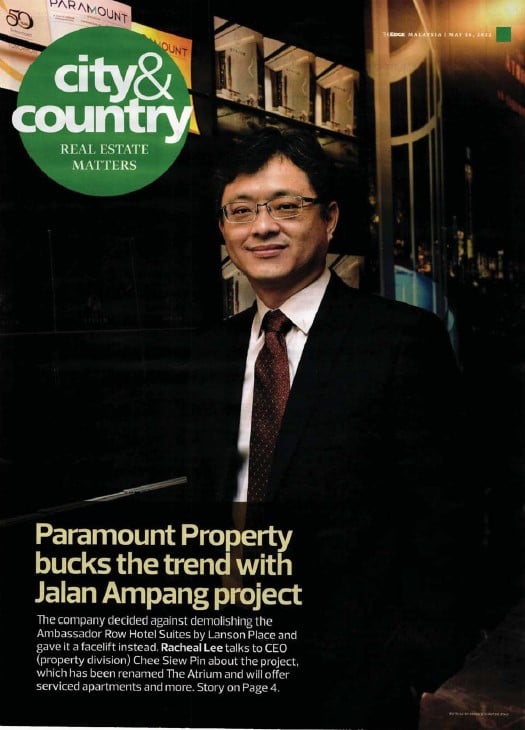

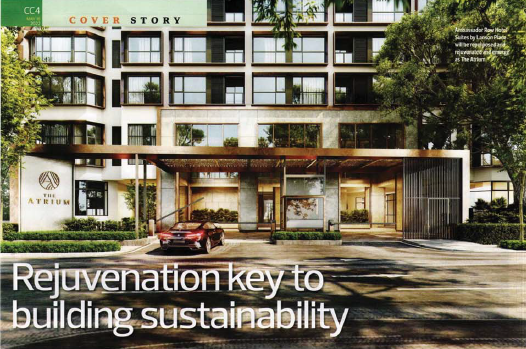

Going against the grain can be challenging, especially in today’s market conditions, but Paramount Property Development Sdn Bhd is not afraid to do the unconventional. Instead of demolishing the 20-storey Ambassador Row Hotel Suites by Lanson Place in Jalan Ampang, it decided to keep the structure and renamed it The Atrium.

“We repurposed and rejuvenated the building. We are keeping the structure but we tore down all the mechanical and electrical systems and piping, replacing them with new ones. We are even changing the lift system and the facade. In many European countries, it is common to rejuvenate a building and change the facade,” CEO (property division) Chee Siew Pin tells City & Country.

“As we are not tearing down the whole building, there is not much hacking and pollution involved, and there is less wastage, which helps reduce the carbon footprint as well. We also kept the sky terraces [on the 6th and 13th floors] where many others may have chosen to cover them up and put in more units. It is Paramount Property’s take on sustainable development — repurpose and rejuvenate to meet modern sensibilities, accentuated by a new, artistic form,” he says.

Chee, a trained engineer, recently took the helm at Paramount Property, which has been developing projects since 2005, and is no stranger to property development. Prior to joining the company, he spent more than 11 years at Pantai Bayu Indah Sdn Bhd, a member of ParkCity Group in Miri, Sarawak. Before that, he worked with Impiana Group. His career has allowed him to gain experience in both the property development and hospitality industries.

“Because of my background in the hospitality industry, I always talk about branding… I look after master plans, and my portfolio is also in shopping malls, residential properties, hotels and offices. I like to do placemaking, bring the crowd in, carve out [the development] to serve the community and elevate the lives of the people,” he says.

“I am a people person. I go to the ground, listen to the staff and digest what they say. This is my management style. Also, as a manager, you cannot be too busy or you will not be able to empower the [heads of department] and groom the next generation. We must pass down our knowledge and skill so that they can continue to learn, and it is about sustainability.”

Development given a facelift

In rejuvenating The Atrium, which has a gross development value (GDV) of RM212 million, Paramount Property recycled the building materials as well as furnishings and fittings — some were donated to charitable homes and flood victims, and some were sold to budget hotels.

Furthermore, it allocated 30% to 35% of space to landscaping.

The Atrium offers 241 serviced apartments on a 0.95-acre plot. It was launched last November, and more than 80% of the units have been sold. Completion is 24 months from the signing of the sale and purchase agreement.

“The Atrium checks all the right boxes, with its prime location and views of the city skyline as well as its modern design, curated communal facilities and ample greenscapes. It is also competitively priced from RM1,010 psf, and our strategy has always been to launch good products at the right price points. The encouraging response to The Atrium has affirmed that this strategy works,” Chee says.

The serviced apartments — measuring 566 to 1,227 sq ft — offer 12 layouts with configurations of 1 bedroom + 1 study + 1 bathroom; 2 bedrooms +1 study + 2 bathrooms; as well as 2 bedrooms + 2 bathrooms. The units are furnished with electrical appliances and digital locksets. Each unit will have one parking bay but some of the larger units will have two.

Facilities will include a barbecue area, children’s playground, Jacuzzi, sky terrace, reading nook, yoga lounge, chill-out lounge and wading pool and an infinity pool. The indicative maintenance fee inclusive of the sinking fund is 50 sen psf.

“Our buyer profile is a roughly 65:35 mix of owners and investors. The majority — about 73% — are aged 25 to 45, and this matches our original target. About 3.5% are foreigners, whose children attend the international schools nearby,” Chee says.

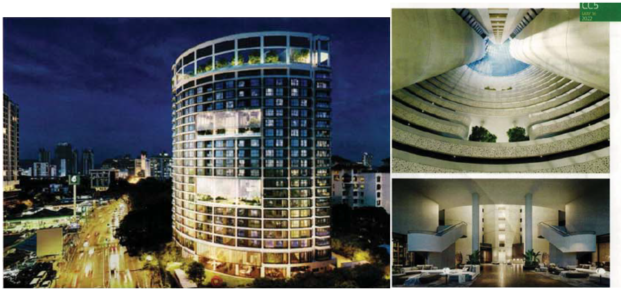

The building’s core feature is an atrium, which Chee says allows more natural light and ventilation into the building.

The developer was allowed to build more floors but decided against it. “The company’s vision is to change lives and enrich the community for a better world. The original plan was to build 30 storeys, so the foundation was built for that. Even DBKL (Kuala Lumpur City Hall) allowed us to increase the density by 30% but, we thought it would be good to keep the building itself [at 20 storeys]. We added only one level on the rooftop, where the facilities will be,” says Chee.

The Atrium has easy access to major highways such as the Ampang-Kuala Lumpur Elevated Highway, Maju Expressway, Middle Ring Road II and Duta-Ulu Kelang Expressway. It is also near the Ampang Park, Dato Keramat and Jelatek LRT stations.

Nearby are medical centres such as Gleneagles Kuala Lumpur, HSC Medical Centre, KPJ Ampang Puteri Specialist Hospital and Prince Court Medical Centre.

The Atrium is part of a 4.54-acre parcel that Paramount Corp Bhd purchased in 2020 from the subsidiaries of Singapore-listed Wing Tai Holdings Ltd. An existing 132-unit low-rise condominium, which sits on the remaining 3.5 acres, will be torn down to make way for a condo development of more than 400 units. The total GDV of The Atrium and the new condo is RM968 million.

(Clockwise from left): The Atrium is part of a 4.54-acre parcel that Paramount Corp purchased in 2020; the building’s core feature is an atrium that allows in more natural light and ventilation; the building has been repurposed and rejuvenated to meet modern sensibilities.

Future launches

Chee says Paramount Property is planning six launches with a sales target of RM1 billion this year. These projects are located in Section 14 in Petaling Jaya; Greenwoods in Salak Perdana; Kemuning Utama; Sejati Lakeside 2 in Cyberjaya; Batu Kawan in Penang; and Bukit Banyan in Kedah.

He expects the property market to remain soft in 2022, depending on the country’s economic and financial outlook.

“The move into the endemic phase is expected to restore consumer confidence and aid the recovery of the property market in 2022. Downside risks remain, namely the developments surrounding Covid-19, both globally and domestically,” he says.

“Headwinds such as uncertainties arising from the emergence of a new variant of the virus, interest rate hikes, escalating prices of building materials and shortage of construction workers could dampen the property sector’s recovery.”

He notes, however, that the record-low interest rate environment and abolishment of the real property gains tax for disposals from Year 6 will help invigorate the property market. As such, he foresees that the market will be more sensitive to customers’ needs and demands, and provide more value for money, quality and functionality.

While the property development industry is on the road to recovery, he reckons that inflation is imminent, and the industry is experiencing the issue of high material prices affecting developers’ margins.

“What is happening in the market is that developers are experiencing a squeeze in margins but, at the same time, buyers are looking for discounts. Soon, most developers will offload their inventories, and property prices will go up.

“For many Malaysians, the best way to hedge against inflation is to buy property, and it is a way of keeping [the value of] our money.”

Paramount Property has a full plate but, by keeping a steady focus on what needs to be done, it is building a foundation for further expansion.

(Clockwise from left): Sky Terrace; Type E Living Room; Rooftop Swimming Pool