empty marble floor and cityscape of kuala lumpur at twilight

Hello 2020! A new decade has just begun. From social media to Big Data, the previous decade saw the advent of new technologies changing the dynamics of every industry including the property industry.

Besides digital disruptions, a myriad of other issues have remained on the lips of many. Take the issue of housing affordability for instance — a Bank Negara official in October 2019 labelled houses in Malaysia as “seriously unaffordable” by international standards. We have yet to see any realistic solution to this.

Amid the tepid, trying market of recent years, we have seen the introduction of homeownership schemes, the Home Ownership Campaign (HOC) and alternatives such as property crowdfunding and rent-to-owns (RTOs) giving the market a needed shake-up.

In EdgeProp.my’s poll of some 17 leading property developers in the country and the Real Estate and Housing Developers’ Association (Rehda) on lessons learnt over the past decade and what they foresee the 2020s will bring, they were certain of one thing — that change is inevitable.

As the new decade progresses, Malaysia’s property developers expect the country’s demographics to evolve with an ageing population growing while a more “millennial-centric” market will emerge. At the same time, more of the younger millennial generation will join the workforce.

Demands are shifting, and a house is today more than just a roof over the head for many — it is part of their lifestyles. Developers know they have to step out of their comfort zones, be flexible and adapt to the discerning homebuyers’ ever-changing wants and needs.

Furthermore, there will be greater emphasis on sustainability and in reducing carbon footprint as climate change becomes the defining issue at this juncture.

The industry also hopes that the government will step up and play its role to facilitate a healthy property market. Policies are to be reviewed and numerous laws are due for amendments to keep them in line with current and future market needs and conditions. By engaging with relevant stakeholders, laws and regulations can be better crafted to suit the people.

In terms of the economy, fostering greater economic activities translates to greater income levels.

Hindsight is always 20/20 but as long as we learn (and adapt) from the past, the industry should be in a position to better handle the challenges and opportunities that lie before us in the coming decade.

Read on for each developer’s predictions and business strategies going forward.

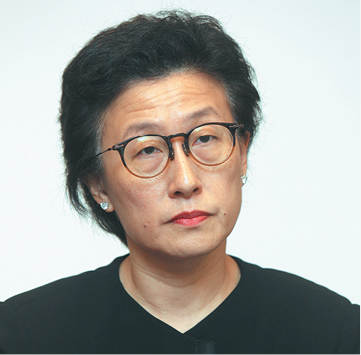

Datuk Khor Chap Jen

S P Setia Bhd president and CEO

Lessons learnt from the past decade

The past decade saw the quick market recovery from the Global Financial Crisis in the late 90s owing to the then-innovative Developers Interest Bearing Schemes (DIBS) which started well but due to the exuberance and abuse by some, the scheme was regrettably banned and cooling measures were introduced in 2014 leading to a somewhat dampened market until now.

The decade also saw the rise and popularity of themed gated-and-guarded communities as more discerning homebuyers prioritise safety and well-being for their loved ones. In the urban areas, an abundance of serviced apartments were launched, resulting in an oversupply in the market. We also saw the reviewing and rebranding of negatively perceived low-cost units to affordable housing at both state and national level.

What to expect in the new decade

For the next decade, given the renewed focus in building and expansion of rail infrastructure, new centres of development are anticipated to sprout aggressively within the proximity of the various stations planned. We will also see rapid digitisation influencing our way of life, and in particular, at work, resulting in new concepts of property unit sizes and layouts and evolving integrated development models catering to this new lifestyle.

We will also see the rising demand for aged care and senior living in Malaysia. The population statistics show that Malaysians above 60 years old have steadily increased and this growing segment is likely to create a need for old age care in the communities they live in.

Moving forward

To address the changing needs of the Malaysian population, existing development infrastructure will need to be refurbished and new ones introduced to offer barrier-free homes and age-friendly features.

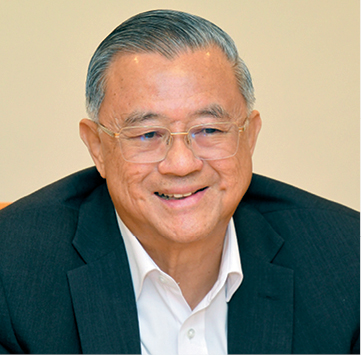

Tan Sri Leong Hoy Kum

Mah Sing Group Bhd founder and group managing director

Lessons learnt from the past decade

From my experience over the past 25 years in the property development industry, I have always believed that “the only constant is change”.

Amongst the most notable changes over the past decade would be how property developers plan and execute our business strategies in view of advancements in information technology amidst the digital boom.

Digital disruptions have altered things from a sales and marketing perspective, in consumer behaviour, and even for loan applications.

A shift from the high-end segment to the mass-market segment began in 2013, catering to the M40 and B40 group in view of the changing global economic and geopolitical sentiment. This sentiment is expected to continue over the near to medium-term period.

What to expect in the new decade

The property development industry is expected to face another wave of digitalisation as we move into an era predominantly run by the internet-of-things (IOT). These digital advancements will enable the industry to fill in the many gaps in areas that require intense human supervision, especially in the construction and project execution stages.

I personally hope that there will be more robotic supervision in critical areas to ensure that things are recorded more accurately whilst increasing productivity and consistency.

There is also a strong call for a circular economy in view of IOT advancements which may further alter future homebuyers’ purchasing patterns. Property as a form of safe-haven asset may transition into a form of sharing economy — similar to the evolution of e-hailing cars with the likes of Grab and Uber.

Moving forward

In order to spur property ownership, the Rakyat must first have a reasonable income, to be able to afford big-ticket purchases such as property.

We appreciate the government’s on-going initiatives to make the economy more sustainable — promoting wealth creation to increase the Rakyat’s income level.

Industry players must establish strong branding DNA backed by an impeccable track-record, with good talents to help revitalise the industry and enhance appeal for buyers.

I still believe that property development remains a sunrise industry but we have to continue to come up with strategies to adapt swiftly and effectively in a rapidly evolving climate. It should be a better environment for the industry overall in the next decade.

Ngan Chee Meng

Gamuda Land CEO

Lessons learnt from the past decade

i. Adopt long-term view of the market

In the last five years alone, Gamuda Land successfully launched three of our new flagship townships in Malaysia: twentyfive.7, Gamuda Gardens and Gamuda Cove. We made upfront investments in our townships i.e. creation of a lush central park, ensuring proper roads and accessibility, creating activities and catalyst for growth in our townships through our placemaking strategy to ensure continuous value creation. The thought put into our town planning is what attracts people to our developments as they see a rewarding future. Our sales results have been on the uptrend in the last decade, with a record high of RM3.6 billion in the financial year ended July 31, 2018.

ii. Agility to adapt and respond to ever-changing market

Gone are the days where property developers focus solely on location. In an era where customers are more discerning, we have learned to be more creative, agile and holistic in all we do by adopting technology and rolling out products that are new and suit the market.

iii. Recognise and seize opportunities when they arise

Gamuda Land expanded our town-making expertise into Vietnam — Gamuda City in Hanoi (2008), Celadon City in Ho Chi Minh City (2010), 661 Chapel St in Melbourne (2015), GEM Residences in Singapore (2015) and Anchorvale Crescent (2019). Our decision was proven right as the performance of our projects overseas has been exemplary, providing a buffer to earnings as the Malaysian market remained soft. Our overseas developments contribute over 70% to our sales.

What to expect in the new decade

A key concern is climate change, which will continue to drive developers’ efforts in the new decade. Gamuda Land will increase our sustainability efforts by looking beyond sustainable landscaping to enhance biodiversity in our townships and how we can better plan and build our developments to reduce carbon footprint.

For sustainability, we are also adopting smart city technology in our newer townships through smart planning, for better safety and convenience, to improve walkability and bike-ability and implementing smart transportation via green vehicles both within and beyond our townships.

Development on our ongoing projects overseas will continue, including our new project Anchorvale Crescent in Singapore following the 100% sale of GEM Residences. In Australia, we have 661 Chapel St in Melbourne, where sales and expansion into this market will be accelerated by the Group’s (Gamuda Bhd) investment in Martinus Rail Pty Ltd, the largest independent specialist rail constructor in the country. We will remain on the lookout for new land bank in these countries.

Moving forward

The industry is ever evolving. Digital revolution and climate change should be subject to proper regulations and incentives to encourage efforts in these areas to create developments that are future proof. This is how we can amplify our effort in line with the United Nations Sustainable Development Goals (UNSDG) 2030.

Datuk Seri Fateh Iskandar Mohamed Mansor

Glomac Bhd Group managing director and CEO; Rehda immediate past president

Lessons learnt from the past decade

Firstly, income has not grown in tandem with the rising cost of living, and by extension, housing prices. The high cost of living has made it difficult to finance a home.

Thus, demand for premium or high-end property is decreasing. Over the past few years only 1-2% of new launches were properties priced from RM1 million and above. Of late, most launches range in price from RM250,001 to RM500,000. In 2018 alone, more than 40% of launches were from this category. Glomac’s recent launches of 121 Residences and Plaza@Kelana Jaya cater to this demand, being priced within said range.

Mismatch of property supply and demand stems from a lack of coordination and planning. Solutions like Big Data are needed to manage the supply side to mitigate this issue.

What to expect in the new decade

With the nation’s need for practical and affordable housing, Malaysia’s property landscape may shift significantly towards:

i. Mixed-use development / integrated development

Scarcity of land in urban areas lead to integrated developments where homes, offices, restaurants, shops and entertainment outlets are stacked vertically, or constructed within walking distance for connectivity and convenience.

ii. Smaller units and transit-oriented developments (TOD) for a sustainable maintenance culture

Rising property prices is perhaps the main concern of potential homebuyers. Rising costs and the need to offer more common facilities within a residential development have resulted in smaller homes, which in a way, fit the lifestyle of millennial homebuyers.

iii. Creative or innovative packages by developers

Some developers offer packages that help homebuyers with rebates and discounts of up to a certain level with the remaining portion financed by the developer itself at no interest. Others offer services to navigate the various financing options in order to help bridge the differential sum between price and the purchaser’s end-financing loan amount.

Moving forward

Coming from a Rehda Malaysia patron’s perspective, the association has a “Developers’ Strategy” in response to several issues. Amongst them are:

i. To facilitate homeownership

• Banks/ financial institutions should make innovative financing packages more flexible to help buyers, especially first time house buyers, and offer end-financing to borrowers even without credit history record.

• The step-up financing scheme to be given higher allocation (currently only available for PR1MA homes) and widened to cover affordable homes in the private sector.

• The disbursement of the 10% down payment from EPF to be channelled directly from EPF to the developer.

ii. Bumiputera quota policy

We would like to urge the government for a more practical and transparent guideline to ensure consistent implementation of the policy and its release mechanism. The bumiputera quota should be standardised across all states and be capped at 30% while the release mechanism should be standardised, properly structured and transparent.

iii. Addressing oversupply issue

• Government can consider buying developers’ balance completed units and convert the units into RTO units. Incentives should be given to developers who utilise unsold stock for other uses, for example, converting unsold units to rental units (with rental income not taxable for a certain period).

• To allow projects with less than 40% sales to be terminated and the monies refunded in full to buyers without any penalty.

• Government/state government agencies to focus on providing houses for the B40 group and not compete with the private sector.

iv. To reduce the cost of doing business

There is an urgent need to review and lower or abolish unnecessary charges or requirements to reduce the cost of doing business so that the savings can be passed on to house buyers. Private utility companies such as SYABAS, Indah Water Konsortium, Tenaga Nasional Bhd and Telekom Malaysia should not impose capital contribution charges on developers as developers are already required to lay infrastructure in their projects.

Datuk Soam Heng Choon

Rehda president

Lessons learnt from the past decade

The Malaysian property market has been facing numerous challenges over the last few years. For developers, the last decade began with a significant improvement in the property sector after the Global Financial Crisis with ample cash due to the quantitative easing in many economies around the world. As a result of the improved sentiments, 2010 to 2014 saw the entry of many non-core developers into the industry. Buyers were queuing at developers’ galleries as they can obtain end-financing easily and with interest capitalisation schemes, the differential sum required was low, making it easier to buy a property.

Prices increased at a fast rate and the government introduced cooling measures in 2014 to slow down the rate of price rise. As a result, the industry has been experiencing a downturn over the last five years of the past decade, leading to unsold inventories and making housing unaffordable.

We should learn from the last 10 years that as property is a cyclical business, we should ensure its long-term sustainability. Developers should do thorough feasibility studies with regards to the location, type of product and pricing in a particular location to ensure good take-up.

On housing being unaffordable, despite a very flat market over the last five years, the government should seriously look at enhancing income levels. Non-core developers should not enter the business without understanding the challenges. Developers need to keep abreast with changes and remain competitive. Developers should rely on data to make informed decisions to ensure sustainability of the industry.

What to expect in the new decade

Developers are cautiously optimistic for the next decade. The next 10 years will see the commencement and completion of various mega infrastructure projects like the MRT2, MRT3, ECRL, HSR, RTS, West Coast Expressway Pan Borneo, Tun Razak Exchange and Bandar Malaysia which could provide the catalyst for property development along the corridors of these new projects.

As we start the new decade with high unsold inventories, developers could possibly look at consolidation and emerge as stronger and leaner entities.

The push to adopt Industrialised Building Systems (IBS) and other technologies in property development would be embraced by more developers and could help in reducing dependence on foreign labour and help developers adopt the sustainability agenda in a bigger way.

Moving forward

Surviving in a challenging and demanding market will entail greater effort, hence it is vital for developers to adopt digitisation and Industry Revolution (IR) 4.0 in their development processes to be more efficient and to deliver quality products.

The government should harmonise all policies on bumiputera quota and affordable housing nationwide as the cross subsidy model has caused prices to increase in market-driven products. There is a need to review policies and help to reduce cost of doing business as the selling price of property is a summation of all input costs.

In the new decade, there is a need to amend and to accelerate the amendments to various laws and Acts related to the property industry.

The government should also focus on providing social housing and let developers focus on market-driven products.

Tan Sri Lim Hock San

LBS Bina Group managing director

Lessons learnt from the past decade

The Malaysian property sector has evolved tremendously, influenced by the growing population, changing housing needs, and subdued house-buying sentiments. Still, property prices in Malaysia remain among the most affordable in the region.

Over the years, LBS has learnt that success depends on the ability to be flexible and responsive to market changes, thus we now strive to meet buyers’ needs based on affordability, connectivity and community.

Increasingly, homebuyers want more than just a roof over their heads, so, LBS focuses on providing products that meet their needs in the right location, and more importantly, within the right price range.

What to expect in the new decade

Looking forward and beyond, LBS reckons the property sector will continue to grow and evolve along with changing demographics and the emergence of new technologies and lifestyles.

LBS believes the Malaysian property market will have a more positive outlook in a few years with homeownership being top priority for most Malaysians.

Climate change, ageing population, land scarcity and urbanisation will change demand for properties in the next decade. Technology will continue to disrupt the industry — changing the way developers operate, and the home-buying experience. Developers will have to adapt quickly to these changes and embrace new technologies — whether in design, building, marketing or home purchasing, to remain resilient.

Moving forward

The property sector will continue to face challenges brought about by US-China trade conflicts, slowing global economy and weakening consumer sentiment. That’s why to succeed, property developers need to put people and communities’ needs first. We need to put ourselves in the shoes of our homebuyers, studying their needs and lifestyles in order to create homes that will improve their lives. LBS always strives to create vibrant communities — a place for families to bond and the community to connect.

We hope the government can take further steps to boost affordable housing through closer collaboration between the state and federal governments to ensure effective planning and implementation of affordable housing projects as well as providing further incentives for the adoption of IBS to speed up delivery of quality homes and bring down house prices. We also hope that banks will look into more innovative financing models to make homeownership more affordable for Malaysians.

Anwar Syahrin Abdul Ajib

UEM Sunrise Bhd managing director and CEO

Lessons learnt from the past decade

UEM Sunrise’s (UEMS) brand story is at heart one of belief, optimism and resilience. As the pioneer developer of Mont’Kiara in Kuala Lumpur and Iskandar Puteri in Johor, the single largest integrated development in Southeast Asia, we have shown the importance of a strong vision and strength in execution to create what stands today as transformative developments.

One of the key lessons that we have learnt is the need to be ready for business cycles. We must make sure we take advantage of the boom cycle but be ready for the bust cycle. Risk management is important to ensure the company is able to withstand shocks. There needs to be a balance between landbanking and projected gross development value. A well-diversified GDV portfolio is important but we cannot be hoarding too much land in our books and have too much money tied up in land. A clear product launch programme that is well diversified in terms of geography, categories of products and price points must be in place. At any one point, when the cycle changes, you are able to adjust and activate a different strategy.

Be close to your customers. Owning a house involves a lot of money and most of the time, it involves a person’s life savings. We must be sensitive of this fact and ensure there is capital appreciation in the products we sell. There will then be brand loyalty and more opportunities will come our way. As the middle-class base in the country expands and the level of sophistication grows, we must educate our customers about the new norms in buying homes, investments and capital appreciation. The rapid growth in house prices between 2008 to 2013, which were driven by speculation and easy-owning schemes, are now things of the past.

Success in any development is about the creation of a vibrant community. Mont’Kiara is vibrant because it caters to the needs of people living there. Most places are within walking distance. I can send my children to school, then walk to my yoga place followed by breakfast at my favourite cafe. After that, I can do my grocery shopping and visit the bank before I fetch the kids. How do we “gel” the connectivity for all these? A key element is the walkability from one point to the next. We have to understand and apply those lessons in Mont’Kiara at our newly launched Kiara Bay development.

What to expect in the new decade

The need to be responsible for our planet and its population has never been more paramount. We have seen massive development but it has caused the degradation of our planet driven by consumption of natural resources, increased demand for energy, increased pollution and creation of more waste. Buildings are major contributors to global greenhouse emissions (nearly 40% according to a report by the Global Alliance for Buildings and Construction). This mainly comes from building operations and construction-related activities (excluding external infrastructures). I haven’t even touched on other targets as described in the UNSDG.

We have to take action and we can start with little steps. Many of the global challenges mentioned within the UNSDG are relevant to Malaysia. We talk about income disparity, food wastage, education levels, economic growth, scarcity of basic infrastructure and many others. As a major player in the real estate space, the most relevant will, of course be about sustainable cities and communities. It is projected that globally, five billion people will be living in cities by 2030. In Malaysia, we are expecting Klang Valley’s population to increase to 30 million by 2030 from just under 10 million currently.

Against the backdrop of a developing/developed nation, we are not only seeing population growth but also ageing population growth

This coming decade will be a defining period for UEMS as we embark on our next 10-year business cycle. Rapid changes in technology, methodologies, and communication are changing the way we work. Efforts are rightfully being made to increase the M40s as well as the T20s improve their lives while people are getting more sophisticated and demanding. How well we know about such trends and changes dictate our strategies for the future.

Building a responsible brand that ticks the right boxes on sustainability, strong values that emphasise business ethics, quality and most important of them all, meeting customers’ expectations is fundamental to long-term survivability. Our customer must see that there is value to our developments. Price is determined by cost and we must make sure we are efficient at managing our cost. We must then also ensure our customers are able to obtain their dream homes easily through innovative financing structures and a hassle-free process.

We are still at the early stage of the 4th industrial revolution for the real estate sector. In entertainment, retail, social media, logistics and leisure, we are seeing how rapid changes are taking place. For the real estate space, we have the likes of Airbnb monetising spaces/property investments but we also see the struggles of WeWork at co-working. What this means is that there are opportunities to be explored and being the first to market doesn’t guarantee success. The coming decade will seek to address the problems of owning a home or other forms of having a secured roof to stay under without needing to own homes. These are some of the things we are looking into.

Moving forward

My view is that we need to focus on a common higher purpose. Malaysia’s unique situation is that we are a diverse population where each community has its own agenda. There has to be a common purpose that unites us all. For example, the UNSDG drive many initiatives that cut across many sensitive issues. Isn’t achieving zero poverty, providing access to quality education, reducing wastage, building sustainable cities and communities, reducing emissions, ensuring responsible consumption and production, everyone’s mission?

When we talk a common language on sustainable development, it will take Malaysia to greater heights. Investors will want to come to invest in Malaysia, Malaysians abroad will want to come back because there are good job opportunities; income levels will increase, the disparity in income levels and standards of living will reduce — the benefits will be tremendous.

The current problems that we see today on affordability, oversupply, and high household debt levels will always be there. That is part and parcel of business cycles made worse by irresponsible capitalist objectives. Unwinding such legacy issues will take time and like many difficult illnesses, recovery will take time.

The country needs to have a strong roadmap that must be executed well this coming decade. We cannot be thinking short term when it comes to sustainability. What we have so far is akin to taking a painkiller to make the pain go away but we are not resolving the root cause of the problem. Building cheaper homes and granting them cheap credit will help us achieve homeownership but does it really ensure wealth creation or are we making them poorer because they are taking on more debt?

Of course, as a listed property developer, the focus will be on the creation of shareholder returns but we must also be able to explain our contribution towards sustainable developments. UEMS wants to be known as an organisation that goes beyond making money but about creating a better future for Malaysia.

Kajendra Pathmanathan

BRDB Developments Sdn Bhd CEO

Lessons learnt from the past decade

The past decade has seen the proliferation of more digital and contemporary technologies which are revolutionising the way BRDB conceives and develops projects, whether it’s the deployment of big data analytics to understand purchaser trends, new construction methods including prefabrication and greater focus on sustainability of the design, build and maintenance of our products.

Whilst it is important to embrace this unavoidable future, we must not neglect the fundamental principles of development; strategic land bank/locations, understanding our customers, and of course, ensuring cash flow is properly proportioned for the entire duration of the development. It is through the consistent application of the fundamentals that we at BRDB can continue our track record of success and excellence.

What to expect in the new decade

I believe we’re in a very interesting period, brought on by unparalleled innovation and the changing expectations of today’s purchasers, exacerbated by headwinds in a challenging property market. Our products will have to change to cater for a millennial-centric market, to develop hybrid products that are value-driven and well-designed which also provide recreational, retail and communal offerings that do not just cater to their needs, but also function as an extension of their personality.

Purchasers are becoming much more discerning, hence developers will have to raise the bar in all that we do to meet and exceed those expectations. I for one, am very excited to see how the changes that will be implemented in our future products will fulfil and exceed the needs of tomorrow’s homeowners.

Moving forward

Much has been said about relaxing the bank lending guidelines, providing more incentives via the HOC and also the rationalisation of the Real Property Gains Tax (RPGT), but I believe that there is a lot to be gained from simplifying how things are done.

For instance, the processes for obtaining development approvals and licences from the various governing bodies need to be more structured to enable developers to better forecast the time and budget necessary for our projects. Our experience on some of our overseas projects have underlined the benefits of having a more templated process and greater procedural standardisation, so it is our hope that by working together, we can bring that same efficiency to the local market as this translates to tremendous cost savings for not just the developers but also for our purchasers.

Ho Kong Soon

Matrix Concepts Holdings Bhd group managing director

Lessons learnt from the past decade

Despite persistent challenges in the property market, developers who remain focused on the long-term vision of its organisation and sustainability of its developments have been justly rewarded. There is a need to be customer-centric and continually create new experiences for customers while ensuring timely delivery and continuous customer care — to prioritise value proposition to property buyers beyond financial considerations.

Most important are positive long-term relationships with buyers with an emphasis on nurturing community-living and increasing engagement with residents, having programmes that create vibrancy and providing lifestyle solutions as part of holistic value creation for a development.

What to expect in the new decade

Developers will have to be agile and nimble to face fast-changing consumer requirements. For example, there will be a growth in sustainably-designed smart homes in Malaysia, although the adoption rate will greatly depend on market acceptance as such products are normally associated with a premium for early adopters. In tackling the potential high costs, Malaysia needs to create a sustainable ecosystem of technical expertise, reliable product supply and consistent demand.

The application of data analytics will be felt more prominently in the next decade. Greater access to consumer behaviour data will allow developers to translate the information and structure products catering to current and future market demands. Digitalisation will also allow developers to improve delivery while increasing operational efficiency and improve cost management.

We also believe there will be greater collaboration among relevant stakeholders in addressing the supply-demand mismatch in the property sector. A sustainable National Housing Policy that is uniform and consistent would be welcome, promoting equitable and progressive policies for all main stakeholders including government agencies, local councils, developers, property buyers and communities. In the implementation of the National Housing Policy, the government plays a critical role as facilitator, coordinator and enforcer.

Moving forward

Developers need a clear vision in addressing the sustainability aspects of their developments, delivering lifestyle requirements while remaining passionate about translating this vision.

Moving forward, property development needs to be increasingly humanised and developers must be more willing to commit towards creating a solid brand identity.

We feel there is a huge opportunity in this sector over the next decade, provided market demands and value creation are given priority.

Ong Ghee Bin

OSK Property CEO

Lessons learnt from the past decade

The property industry has changed tremendously over the past 10 years. People now spend more time doing research to ensure that the property they are investing in or buying for their own stay meets their needs, functionality and value of investment. As such, developers have to constantly evolve to be in tune with market demands and strive to create the right product at the right price and location.

It is also important to diversify the types of products offered such as mixed developments and mixed hospitality developments to provide options to suit the different needs of the community.

What to expect in the new decade

Malaysia is blessed with a relatively young median age (about 28 -29) and this is the exact time when they start looking for a new home or an investment. These days, people desire a quality lifestyle. As developers, we’re not just in the business of building homes, we’re also facilitating a lifestyle for our customers. Hence, it is crucial to understand what’s new in terms of cultural and lifestyle demands. We must stay on top of trends and have a deep understanding of what’s important to people when they’re looking for a new home.

In urban areas, TODs and affordable functional starter homes that offer convenience would definitely garner a strong catchment. In a nutshell, homebuyers are looking for a safe, convenient and affordable range of housing near where they work, shop, eat and play.

Moving forward

To buyers, it is important to buy from a reputable and established developer with a proven track record. Always invest in a prime growth area. Now is indeed the best time to invest as most property prices are at an affordable range.

I think the issue of housing affordability has two sides to it. What is crucial and needs to be addressed is that income level has to increase in order to raise affordability.

We also hope the government will reduce compliance costs as this will lower development costs which eventually leads to a lower property price.

We also call for the government to share and update the town-planning guidelines for higher density developments especially in urban areas where public infrastructure has been improved to support higher plot ratio and density.

Beh Chun Chong

Paramount Property CEO

Lessons learnt from the past decade

The building industry has not changed much over the past decade, although land and compliance costs have increased while income levels have remained flat. Nevertheless, there are always lessons to learn and there are a few that stood out for me.

Firstly, it is crucial for property developers to conduct a comprehensive and detailed market study on current and future market demand of an area before moving ahead. This will minimise the risk of property overhang.

Secondly, quality is key. A poor quality or badly-designed product can haunt you forever, no matter how much money is spent on marketing and branding. Property developers that produce good quality products consistently, with practical designs and easy maintenance, will earn trust and a good reputation over the long run.

What to expect in the new decade

Technology is increasingly shaping the future of the property industry. In line with this, we plan to fully digitise Paramount Property to meet new needs over the next five years.

For instance, in preparation of the younger workforce coming in, we have already embarked on adopting a new way of working by relocating to Co-labs Coworking at Sekitar26 in Shah Alam. We will progressively use more technology to improve our business processes, as well as operational and cost efficiencies.

In terms of products, houses did not change much physically between year 2000 and year 2020. However, as technology advances, the way people buy and sell properties will be significantly transformed 10 to 15 years from now. Living habits will also change. Hence, we are preparing ourselves to ride this wave.

Moving forward, Paramount is also set to venture into other countries in the region to capitalise on the growing globalisation of the property market.

Moving forward

In order to support IR 4.0 and the digital economy, the government is already on the right track with the National Fiberisation and Connectivity Plan (NFCP). Our country’s new vision which focuses on building a more inclusive society and empowering youth is also a step in the right direction.

Part of the reason for the property overhang is the low purchasing power of the general population. Raising household income level should be the government’s objective as it will be the key to resolving the home ownership issue.

For Malaysians to be more competitive and to get out from the middle-income trap, the government can work more closely with the private sector to improve our workforce knowledge and work efficiencies.

Sarena Cheah

Sunway Bhd, property division managing director

Lessons learnt from the past decade

Since 2009, we have seen the real estate industry come full circle where we witnessed strong growth in property transactions in the first half of the decade and a consolidation towards the second half.

At Sunway, we had diversity in geography and asset types which augured well for us across the economic cycle. We have seen that the right products at the right pricing continue to enjoy healthy take-up, and are further enhanced if located within a self sustaining mixed-integrated development.

In the past decade, technology has also changed the way the real estate industry operates. For instance, Building Information Modelling, IBS, AI and IoT have transformed the way we design, build and manage properties.

Online marketplaces enhanced property transactions while crowdfunding and peer-to-peer lending platforms have become a game-changer. Meanwhile, big data and social media is evolving the way we brand-build, connect and serve our communities.

Under our build-own-operate value chain, we have a multitude of opportunities to harness the power of technology to deliver more sustainable urban solutions. More than ever, we have to be dynamic and flexible to grasp opportunities and implement technological solutions for impact and relevance.

What to expect in the new decade

We are at the convergence point of five major trends — rapid urbanisation, technological advancements, demographic shifts, climate change and economic power shifts.

These trends represent an exciting opportunity for citymakers like us who can build, own and operate entire cities and have businesses such as education and healthcare because we can put that all together to engineer the right urban solutions for better cities.

The priority in the next decade is to harness technological developments such as AI, IoT, Big Data, and 5G to maximise value in environments built for growth that progresses people, enterprise, and innovation while minimising the challenges such as housing affordability, congestion, and property maintenance.

For example, co-living communities, purpose-built for the young or the seniors could alleviate affordability issues while providing a sense of belonging.

Housing affordability will continue to be a challenge. We are looking at a shift to landlording instead of ownership where more purpose-built residences are institutionally-owned, and in tandem, the creation of online platforms that facilitate that; multi-varied financing options such as RTO schemes for homeownership and co-ownership and micro-housing.

Moving forward

We enter the next decade against a backdrop of weaker consumer sentiments, fast technological advancements and evolving lifestyles. We hope that policies and regulations can be more flexible and targeted to help address the more immediate issues facing the economy, from both a growth and risk management perspective.

We believe that the UNSDG can be achieved if we all take a long-term view of the ecosystems that we are building by not just looking at the hard infrastructure but also the soft.

Malaysia as a cultural melting pot has inherent advantages in attracting investors from all over the world and we should continue to attract them and make the country even more cosmopolitan.

The government’s drive for digital transformation, building talent, promoting entrepreneurship, and implementation of foreign direct investment-friendly policies will put us on the track for sustainable progress. With greater economic activities, income levels can rise, and thus we will see a re-invigoration in the real estate space.

Gan Yee Hin

Platinum Victory executive director

Lessons learnt from the past decade

One major factor that contributes to a country’s economy and property market are consistent policies that are fair to both developers and buyers, ultimately benefiting the national economy. With clear guidelines and regulations, the property industry will flourish in the long term as a stable market could enhance buyers’ confidence.

Another reason this point is vital is that it is very much dependent on the government’s vision in upgrading Malaysians’ standard of living, although the current focus is on affordable housing.

Nevertheless, we have seen steady growth in certain segments of the property market and positive changes in foreign buyers’ policy. Among them is the government’s promotion of the Malaysia My Second Home (MM2H) programme. Foreign investment in our country is a boon for our economy and property market, making our land prices more valuable.

What to expect in the new decade

We anticipate a growing young population that will continue to create a strong demand for houses in major cities. The rising number of young working adults from across Malaysia who flock to the Klang Valley for job opportunities will continue to support the demand for affordable to mid-range properties.

An affordable development in a good location is what the market needs for now and in the future, as affordable homes is not just about pricing, but also the proximity to amenities.

For instance, our project under the Rumah Wilayah (formerly known as RUMAWIP) scheme, Residensi Wilayah — Vista Wirajaya 1 & Vista Wirajaya 2 in Taman Melati with a ceiling price of RM300,000 exclusively for first-time homebuyers is located adjacent to Tunku Abdul Rahman University College and opposite Taman Melati LRT station.

Moving forward

There should be more enticing policies to encourage foreign buyers to purchase properties in Malaysia in the coming decade. The latest policy to lower the price threshold for foreign purchase from RM1 million to RM600,000 helps, but not much immediate impact can be seen so far. Properties in Kuala Lumpur are still relatively affordable compared with other regional cities such as Bangkok, Jakarta and Singapore which continue to be attractive to foreign investors.

Both the government and the private sector should continue working together on educating property buyers about financial literacy so they could afford down payments and monthly instalments. Affordable living is not low-cost housing (B40). In view of the large middle-class segment (M40), our emphasis is on properties in strategic locations with quality build and the convenience of urban amenities; thus delivering value for money to young buyers and families.

On the sustainability front, more incentives and encouragement should be given to developers to move towards sustainability by mitigating the cost of maintenance and utilities, among other items.

Ghazie Yeoh Abdullah

Thriven Global Bhd (formerly known as Mulpha Land Bhd) group managing director

Lessons learnt from the past decade

The past decade was a period of major and rapid transformation. The progression into the digital era was a crucial element in sustainability for many companies especially property sales.

In terms of marketing tools, there was major transformation from conventional main stream marketing tools, such as magazines and newspapers to digital marketing tools, such as social media, creative marketing and visual-based marketing which were influential in buyers’ decision-making process.

There were also major changes in housing regulations such as the Housing Development Act, the Strata Titles Act, local council regulations as well as the approval and deliverables of the utility companies that all made the decade a challenging period for the property development segment.

Such a difficult market requires innovative ideas to embrace the challenges.

What to expect in the new decade

The new decade is going to be about globalisation, moving from asset ownership to sharing basis. For example, in the past decade, we saw transformation into co-working and the next decade we will see the trend shift to co-living. And, instead of buying one unit, you could buy a share of a building where you have the right to use for a certain period of time.

The world is becoming smaller day by day, travels are becoming more rampant and everyone wants to have larger or global coverage. On the other hand, everything is going to move to a smaller scale, for instance, smaller offices, smaller homes, smaller retail lots — this will happen due to digitalisation.

The other segment will be public transportation. We see that this will also impact future homes, offices and retail development decisions.

Moving forward

For investors, property is still the best form of investment on a long-term basis. It is a form of forced saving as well as a non-perishable item which will appreciate in the long term.

A roof over one’s head is important not only for one’s own generation but for future generations. It will still be the same case in future and I will like to remind all investors of this key element.

For developers, as globalisation sets in, we need to arm ourselves with strong resources and one way is by sharing the pie. Developers should look into undertaking more joint ventures and target overseas markets to expand our reach and be more competitive. Digital marketing allows us to cross boundaries but comparing ourselves with our neighbours such as Indonesia or Thailand, we won’t be able to compete if we don’t work together as one.

Government agencies such as utility companies, local councils and key policy makers must engage with the ground and listen to the challenges and issues faced by the industry players. Timely review of policies could effectively improve market conditions which in turn could reduce the cost of living and reduce the cost of developing homes for the mass population.

Teh Lip Kim

Selangor Dredging Bhd group managing director

Lessons learnt from the past decade

The last decade have reinforced my belief that, in life and business, it is vital to be resilient. The last year has seen tighter lending guidelines for bank loans and less sales. In hindsight however, I believe that with every product, we have crafted and curated to deliver as much as possible, an extraordinary living experience. We always go the extra mile to think of solutions that intelligently respond to the way we should be living.

Currently, we are looking at clearing the current stock we have and to keep trying harder. This also goes back to being genuine and sincere in developing what’s best for the current market. We have also now come up with smaller size units to cater to the millennials and we have learnt to adapt to the current trends.

What to expect inthe new decade

The rise of the millennials. This important segment of society will become more pronounced and influential in the next decade. Today’s millennials are a different generation from the older one. Young people today have grown up with the internet, embraced digital lifestyles and are on constant lookout for opportunities that would better their lives.

Hence, we need to take them into consideration at all times and we have incorporated their needs and wants into our current and future developments. For example, SqWhere Serviced Apartments has been developed based on millennials’ needs and incorporates co-working spaces, especially with the rise of freelancers and bloggers these days.

Moving forward

As we move forward in this new decade, we should be geared towards the millennials and their characteristics. We are currently researching their behaviours and how they value certain things — such as going back to basics and buying from a company that has a purpose. So, we are trying to incorporate these elements into our future developments.

Tan Sri Ter Leong Yap

Sunsuria Bhd executive chairman; National Chamber of Commerce and Industry of Malaysia president

Lessons learnt from the past decade

Never take anything for granted

From Donald Trump to Boris Johnson, there is always a possibility of unlikely events happening regardless of what experts say; hence, we must always be prepared for all possibilities.

Terrorism and extremism

While the world has advanced in so many ways, the many violent incidents such as shootings or stabbings around the world seem to point to a growing frustration over various social or ideological issues that remain unresolved or ignored. We have also shown how reactive we are to such incidents. The increase in investors from Hong Kong following the latest bout of riots there is an example of how those affected are quick to look for safer havens. This could also impact their decisions on where their children should further their education and hence our focus on the education segment is where we see much future.

Climate change

The environment is an increasingly critical topic but not everyone is taking this issue to heart, which is sad; but seeing grassroot campaigns and individual actions by concerned citizens demonstrate that there is still hope. At Sunsuria, we are committed to ensuring that our developments are both sustainable and green.

What to expect in the new decade

The world is constantly changing and we will need to be prepared for more uncertainties in the future. Yet, some things do not change and we must hold firm to principles of human decency and wanting to make the world a better place — these are timeless and universal values that should never be forgotten.

Moving forward

All stakeholders need to engage meaningfully and proactively in order to achieve a common vision or objective that is shared by everyone — only then would any initiative achieve the necessary buy-in and belief to ensure optimum results.

As responsible corporate citizens, we must hold firm to our principles. By doing right for our future generations, such as focusing on education or building sustainable developments, we are ensuring that we are looking ahead and taking care of our stakeholders in the long run.

Tan Sri Eddy Chen

Perbadanan PR1MA Malaysia chairman; MKH Bhd group managing director

Lessons learnt from the past decade

Lesson 1 – That we cannot take the overall economy for granted. While many developers were prudent following the sub-prime crisis (2007-2010), many were quick to forget. The recovery from the crisis was sharp and prices started to escalate from 2011 to 2015, causing some house prices to increase by as much as 15% a year. This was clearly unsustainable. We didn’t foresee the Ringgit depreciating by as much as 20%. Much of the essential goods and services were quoted in USD and has significant impact on the same. The cost of living spiked and eroded the discretionary spending power of the people and in particular, potential house buyers. This hit the M40 and B40 especially hard. The introduction of the Goods and Services Tax too was untimely. All these and their implications were lost on the industry. Hence, the mismatch in the demand and supply of houses. Real wages hardly grew. The Gross Domestic Product of 5% has little meaning as the relative spending ability is not there. That was Lesson 2. We can no longer rely on the GDP figure to forecast the strength of the economy and hence the housing market.

What to expect in the new decade

I would expect the early part of the next decade to be an incubation period before we see real wages grow and household debt reduced. We may see a more robust recovery in the early half of the decade: 2022-2025. I foresee Bank Negara Malaysia will continue to be cautious in its lending policy guideline and the low-interest regime will subsist. Unless there is a drastic economic transformation, the Tiger era for Malaysia will probably not be seen again.

Moving forward

We will see the Malaysian market being dominated by affordable segments. House buyers would be spoilt for choice if only they could get the necessary loan. Developers will be competing in this red ocean market segment. Developers will scramble to reduce the cost of doing business. More will look at joint venture models rather than buy land outright. The IBS will have to be reengineered to effectively reduce cost of construction and be relevant.

The government must relook its policy to deliver one million houses unless it’s for transit homes. As mentioned above, it cannot enter into the red ocean segment of affordable housing and cause more bleeding. The private sector is the best entity to deliver affordable housing — as can be seen, it can over deliver.

Tan Sri Teo Chiang Kok

Bandar Utama City Centre Sdn Bhd director; See Hoy Chan Holdings Group director; Malaysia Shopping Malls Association (PPK Malaysia) president

Lessons learnt from the past decade

The beginning of the past decade was the continuum of the strong growth of the previous years. In that environment, getting approvals to start development and construction was keen, so much so that developers were willing to acquiesce to increasing compliance costs and requirements from the authorities and utility service providers.

These unprecedented increases continued to add to the cost of development and cost of doing business. In good times, these merely added to the increasing prices of properties.

Once the momentum of economic growth slowed, these added costs became a burden and product pricing became increasingly unaffordable.

This is coupled by the long approval process resulting in development approvals being bunched together which caused the spike in construction and completion coming to an increasingly crowded and unaffordable market, thus, causing the market to move into a down cycle.

To resolve the problem, we need to speed up the approval process so that construction can be carried out to match a rising market cycle.

More timely and comprehensive data of applications and approvals will allow better and accurate market research prior to embarking on new projects.

There must be more justification for imposing new regulations and impositions that are unproductive and merely add to the cost of doing business and are meant only to add to the coffers of the authorities and regulators.

What to expect in the new decade

Technology advancement — digitalisation and Big Data — has disrupted the conventional business model, causing rapid obsolescence to the business life-cycle.

However, there are always opportunities in every challenging environment; to embrace the disruptive environment, we need to be fast, adaptive and agile.

Moving forward

Business is the life-line of any economy and the government must ensure a business-friendly and politically stable environment to encourage investments and confidence especially for long-term and large project investments.

More genuine consultations between the private sector, stakeholders and government ministries, departments and agencies are needed so that policies and regulations can be crafted to achieve the objectives in a non-disruptive and orderly manner.