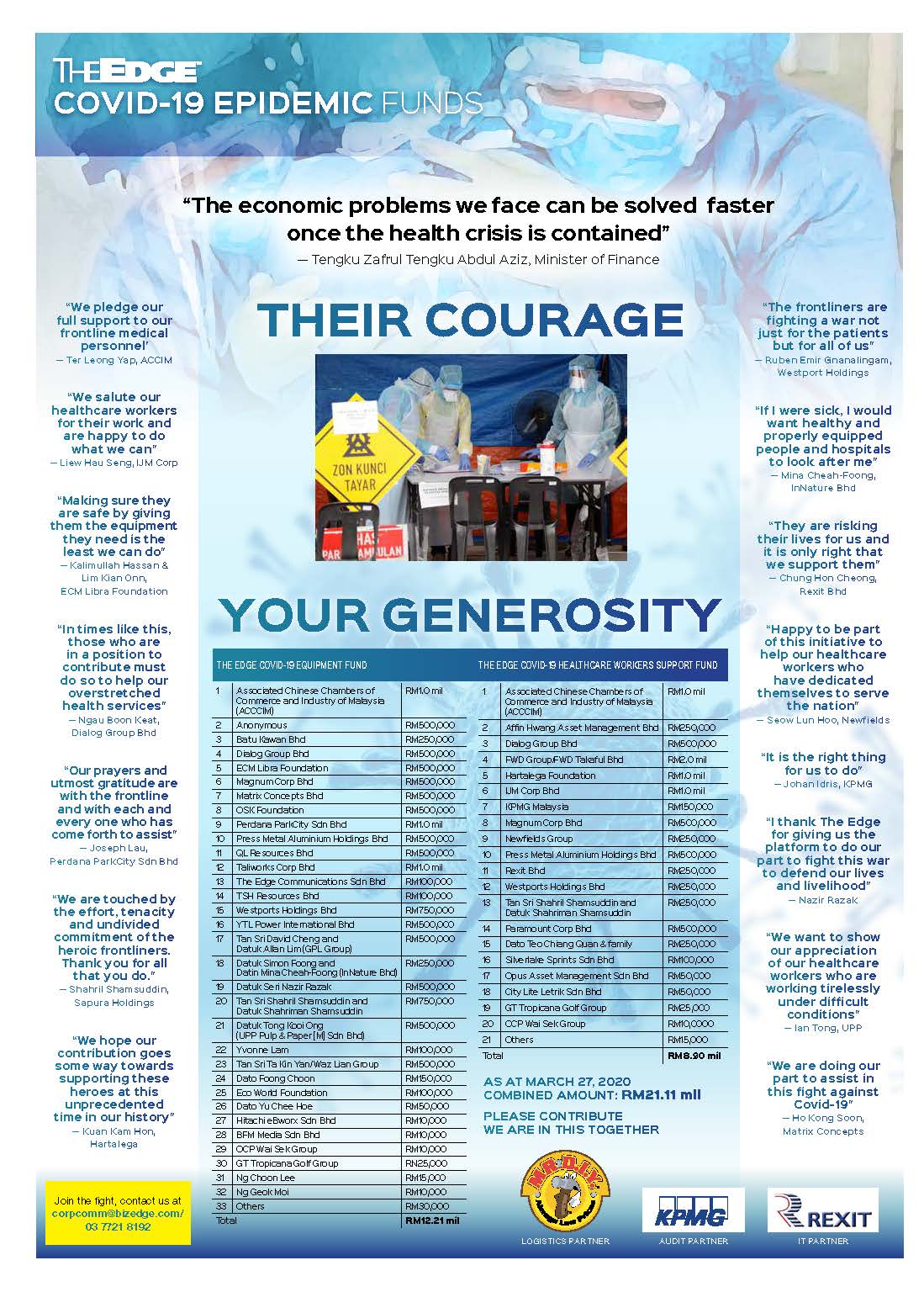

As a member of Paramount Property Circle, earn cash when you introduce our properties to your family and friends!*

Klang Valley

Arinna, Kemuning Utama

Condominium

‧ RM3,000 each

Berkeley Uptown, Klang

Serviced Apartment

‧ RM3,000 each

Affordable Homes

‧ RM1,000 each

Greenwoods Salak Perdana, Sepang

Townhouse, Intermediate Lot / End Lot

‧ RM2,000 each

Townhouse, Corner Lot

‧ RM4,000 each

Sejati Lakeside, Cyberjaya

2-Storey Terrace Homes

‧ 1% incentive on net selling price after discounts/rebates

2-Storey Superlink Homes

‧ 1% incentive on net selling price after discounts/rebates

Sejati Lakeside, Cyberjaya

2-Storey Semi-Detached Homes

‧ 1% incentive on net selling price after discounts/rebates

2.5-Storey Semi-Detached Homes

‧ 1% incentive on net selling price after discounts/rebates

Sejati Lakeside 2

2-storey Semi Detached Homes

‧ 1% incentive on net selling price after discounts/rebates

Sekitar26 Enterprise, Shah Alam

Shop Offices / Office Spaces

‧ 1% incentive on net selling price after discounts/rebates

Affordable Shops Lots

‧ RM1,000 each

The Atera

Serviced Apartment

‧ 1% incentive on net selling price after discounts/rebates

Kedah

Bukit Banyan, Sungai Petani

Phase 7

Sierra Elite 2A (2-storey Bungalow)

‧ RM 10,000

Phase 10

BBBC (2-storey Shop Office)

‧ RM 5,000

Bukit Banyan, Sungai Petani

Phase 11

Sierra Prime (2-storey Semi-Detached Home)

‧ RM 5,000

Phase 12

Senni 3A (2-storey Terrace Home)

‧ RM 3,000

Sierra 3A Elegant (2-storey Semi Detached Homes)

‧ RM 5,000

Penang

Utropolis Batu Kawan, Penang

Phase 1A

‧ Commercial Suites : RM 4,000 each

Phase 3

‧ Sinaran : RM 2,000 each

Phase 3

‧ Sinaran Avenue : RM 5,000 each

Phase 4

‧ Savana : RM 2,000 each

Paramount Palmera, Bukit Minyak

‧ Industrial Unit : RM5,000 each

*Applicable to Paramount Property Circle members only. Terms and conditions apply.