crsupport

Tranquil Living in the City

by crsupport

THE STAR (15 March 2024) – Nestled along the Embassy Row neighbourhood, The Ashwood is more than just an elite enclave surrounded by embassies, high commissions, and top-notch facilities; it emerges as a premium locale for expat living and the privileged class.

With its prestigious address, The Ashwood stands as a symbol of exclusivity and opulence.

Located just 1.8km to the KL city centre, residents will not only benefit from proximity to amenities, corporate offices and renowned educational institutions, but also excellent accessibility with a brief 10-minute drive to KLCC and the Tun Razak Exchange.

Revel in recreational activities from shopping to sports at Suria KLCC, the Kuala Lumpur Polo Club, Royal Selangor Golf Club, KLCC Park, and Titiwangsa Golf Course.

Accessibility is via major high- ways like MEX, DUKE, AKLEH, MRR2 and SMART.

With the conveniently positioned LRT station that connects to the ERL at KL Sentral, the city’s transportation hub, and the MRT station connecting to the ERL at Putrajaya Sentral, this ensures a swift and seamless ride to KL International Airport and throughout Klang Valley.

Experience the best of refined living

As you return home after a long day at work, relaxation and rejuvenation become effortlessly accessible with its carefully designed layouts for exclusive living and well-being, complemented by curated facilities dedicated to leisure and recreation.

The Ashwood was intentionally planned to set its foundation at a strategic location that captures the essence of the Kuala Lumpur cityscape and lush greenery of the Royal Selangor Golf Course.

“For the development concept, we leaned towards a design theme inspired by resorts. It imparts a relaxed ambience to offer an experience reminiscent of resort-style living,” says Paramount Property (property division) chief executive officer Chee Siew Pin.

“We also aimed to ensure the building would feature a time- less design, remaining stylish and relevant for many years to come, without being subject to trends that come and go.”

Chee is optimistic about the property, saying: “It’s strongly influenced by market demand, which we’ve thoroughly researched. Drawing from valuable insights and feedback, we have delved into the specific sizes and demand trends within the surrounding area, with the development centring around people’s preference.

“Our projects are tailored for the nuclear family and expat living, with market research indicating a demand for residences starting from l,300sqft and featuring at least three bedrooms.”

Masterfully crafted home with smart solutions

The Ashwood is a meticulously designed residence, blending timeless aesthetics with cut- ting-edge smart home technologies.

The living spaces are designed to accommodate growing families, offering ample rooms for both relaxation and practical use, and complemented by a minimum of two to six car parking bays.

“All our units are semi-D in design, with wider windows built to maximise cross-ventilation and spacious balconies, allowing owners to enjoy a panoramic view of the KL cityscape and the Royal Selangor Golf Course,” says Chee.

Every unit at The Ashwood comes with a complimentary semi-furnished package that includes premium materials, along with a digital door lock for enhanced security, and a smart home system controllable via a mobile app. This system encompasses lighting, air conditioning, and master switch controls.

The units – with 12 layout options ranging from l,381sqft to 3,399sqft, and up to five bed- rooms – are priced from RM1.641mil for condominiums while villas start from RM4.307mil. The duplexes will be launched in the second phase.

With a gross development value of RM758mil, the project featuring two residential towers is set to launch at the end of the first quarter of 2024, and is expected to complete by 2028.

Curated lifestyle facilities and secure living

Spanning three dedicated zones with a resort-style ambience, these lifestyle spaces offer an idyllic retreat for residents. Its 48 facilities include a 50m-infinity pool, a jacuzzi, an indoor and outdoor gym, a multipurpose court and a yoga deck.

Stimulate your senses with a visit to the herb garden, designed for aromatic pleasures and culinary pursuits in your kitchen.

Enjoy any occasion with stunning views of the KL cityscape from the rooftop BBQ terrace and sky lounge. Whether it is a quiet dinner for two or a lively gathering, it is a perfect venue for all celebrations.

At The Ashwood, every detail is carefully planned – from a dedicated grooming room for in-house pet care to speed ramps in the carpark to control traffic for residents.

Seeing that working from home, online shopping and food delivery became the norm during the pandemic, The Ashwood is contuining these practices by offering a co-working lounge and a dedicated parcel drop-off area – ensuring the evolving life- style is fully supported.

The Ashwood is equipped with a multi-tier security system.

With 24/7 security patrols providing constant vigilance and a dual guardhouse ensuring your well-being around the clock, your safety remains its top priority.

The Ashwood’s visitor screening and management system further enhances the safety measures for residents.

Sustainability at its core

At The Ashwood, environmental, social and governance (ESG) measures stand as its core development principle, reinforced by its ongoing pursuit of the GreenRE certification and adherence to stringent ISO standards.

“Over the past five years, the majority of our projects have been designed with a focus on sustainability, and many have received green certifications. Similarly, efforts are underway to attain GreenRE certification for The Ashwood,” Chee shares.

Its environmental initiatives include temperature control, energy efficiency, and water conservation.

“The incorporation of energy-efficient features can lead to savings of about 5% on energy costs and 10% on water bills for landscaping.

“By offering more open space in common areas and larger balconies for each unit, we estimate potential energy savings on air conditioning of up to 29%,” he says.

The Ashwood features EV charging facilities, solar-powered lighting, rainwater harvesting systems, energy-saving high- speed elevators, low VOC materials, and low emissivity glass windows for cooler interiors.

Prioritising societal well-being, its unit designs emphasise natural ventilation, safety, resort- style amenities, and community building.

Governance is embodied through advanced security measures that redefine premium safety standards.Masterfully crafted home with smart solutions

The Ashwood is a meticulously designed residence, blending timeless aesthetics with cut- ting-edge smart home technologies.

Paramount Corporation Berhad – Looking Forward to Another Record Year

by crsupport

Paramount Corporation Berhad – Looking Forward to Another Record Year

2023 was a Remarkable Year

In 2023, PCB celebrated a year of remarkable achievements. The group achieved a historic FY23 revenue of RM1.01bn, crossing the RM1.0bn threshold for the first time, positioning it as a milestone year. Despite FY23 sales slightly falling short at RM1.12bn (+1% YoY), compared to the targeted RM1.2bn, this was primarily due to the deferment of two projects, namely Savana @ Utropolis, Batu Kawan Penang, and The Ashwood, Kuala Lumpur, with a combined GDV of approximately RM800mn, owing to approval delays. If these projects had proceeded as planned, FY23 sales could have soared to RM1.4bn. To recap, PCB launched new properties with a total GDV of RM886mn in FY23, reflecting a 27% decrease from FY22 and a 41% reduction from the initially planned RM1.5bn launches.

Highlighting the group’s consistent sales resilience over the past years (see Figure 1), FY23 stands out as the second consecutive year where sales exceeded RM1.0bn. This underlines a positive trajectory for PCB, indicating that the challenges faced since the onset of Covid-19 are behind the group. Notably, FY23 represents the third consecutive year in which the group achieved doubledigit growth in both revenue and core PBT, as depicted in Figure 2.

RM1.4bn Sales Target for FY24

The management is optimistic about the market outlook and has set a higher sales target of RM1.4bn for FY24. This is supported by seven new launches, including new phases of existing projects, with an estimated GDV of RM2.4bn, as well as other ongoing projects. PCB is commencing the year with The Ashwood, a luxury high-rise residential development located within the Taman U-Thant neighbourhood in Kuala Lumpur. With a GDV of RM758mn, The Ashwood constitutes 32% of the total FY24 launches. Leveraging the sell-out success of the adjacent project launched by PCB in 2021 (the Atrium) and an appealing selling price of RM1,100-1,200 psf compared to neighbouring projects priced at RM1,400 psf, we anticipate a positive reception for this project.

Co-working Division on Expansion Drive

The Co-working division achieved profitability in FY23, posting a core PBT of RM0.6mn (excluding the reversal of an impairment loss of RM1.4mn), a significant improvement from the FY22 loss before tax of RM0.6mn. This positive shift is primarily attributed to increased revenue across all Co-labs Coworking spaces. As of December 31, 2023, the average occupancy rate was 66%, down from 70% the previous year, largely due to a 37,000 sq ft expansion

in 4Q23. Excluding the new space, Co-labs’s average occupancy would have stood at 75%. In 4Q23, Co-labs Coworking expanded at Ken TTDI and opened a new space at The Five in Damansara Heights, Kuala Lumpur, in Jan-24. Additionally, it expanded the Tropicana Gardens space in 4Q23, bringing the total locations in the Klang Valley to seven, with a combined space of 167,000 sq ft.

The rise of remote work and flexible schedules has made co-working an ideal solution for adapting to the evolving demands of the post-Covid office environment. This shift is evident in the encouraging occupancy rates of two new locations; Co-labs Coworking Ken TTDI reports a 50% occupancy rate, while Co-labs Coworking The Five stands at 40%. Additionally, management revealed that negotiations for the eighth location, situated in the Klang Valley within a transit-oriented development, are in the final stages. In the next two years, the company aims to expand its co-working space beyond Klang Valley and double its total space under management to 300,000 sq ft across Malaysia.

Impact

Incorporating the FY23 actual results and refining our model, we adjust our earnings forecasts for FY24 and FY25 by +1.4% and -2.1%, respectively. We introduce FY26 net profit of RM101.5mn (+5.8 % YoY).

Valuation & Recommendation

We reiterate our optimism in PCB’s earnings growth in FY24-26F, backed by sizable unbilled sales of RM1.4bn and robust property sales. With a record planned launch of RM2.4bn, we anticipate PCB to achieve record sales and net profit levels for FY24. Additionally, the healthy net gearing level of 0.4x positions the group well for strategic land acquisition initiatives. The group’s target of acquiring RM200mn worth of land annually underscores its commitment to sustaining annual sales of no less than RM1.0bn.

Rolling forward our valuation base year to CY25, we arrive at a new TP of RM1.47/share (previously RM1.17/share) based on a higher P/Bk multiple of 0.6x (previously 0.7x). Maintain Buy.

Paramount Aims for RM1.4b Sales in FY2024, Flags Potential Property Price Increase

by crsupport

KUALA LUMPUR (March 5): Paramount Corp Bhd said on Tuesday it aims to sell RM1.4 billion worth of properties in the financial year ending Dec 31, 2024 (FY2024), as the company ramps up launches.

The real estate developer plans to launch projects worth RM2.4 billion in gross development value this year, including some delayed projects, group chief executive officer Jeffrey Chew Sun Teong said at an earnings briefing. Some of the projects were stalled in 2023, due to delays in obtaining the necessary approvals, Chew noted.

“We are launching a lot more than last year. The reason is not because we are crazy, but RM700 million [worth of properties] was delayed [last year],” he said.

Last year, Paramount sold properties worth RM1.12 billion, a record high, with products launched worth RM886 million, compared with RM1.21 billion in 2022.

Paramount booked a 37.6% jump in net profit to RM82.84 million for FY2023, from RM60.2 million for FY2022, as revenue rose 19.44% to RM1.01 billion from RM847.46 million, mainly fuelled by improvements in all its business segments, namely property, co-working, investment and others.

“We will become more efficient in terms of margins, which will also increase our ROE (return on equity),” he said. “We have been working hard to improve this.”

Paramount’s ROE rose to 5.7% in FY2023, from 4.2% in FY2022 and 2% in FY2021.

Chew flagged rising costs following an increase in the sales and service tax to 8% effective last Friday, and the company may consider raising prices to protect its margins.

The higher rate is ‘neutral from the property developer perspective’, though it may affect ‘other areas’, and the cost increases may trickle into later projects, Chew said. “For any industry, if you find that your cost has gone up, you tend to pass this cost to someone else as a business, and generally, you could create an inflation issue overall.”

BFM – Paramount At The Next Stage of Growth

by crsupport

Recent results, saw Paramount Corporation Bhd’s revenue surpass RM1 Billion. What then is their target for 2024 and will property still remain the main focus of the company? Questions we pose to Jeffrey Chew, their Group CEO, whilst asking him why the share is relatively unloved when the valuations are undemanding.

Paramount Achieved PBT of RM130.2 Million FY2023; Declared 4 Sen Dividend

by crsupport

Petaling Jaya, 28 February 2024: Paramount Corporation Berhad (Paramount) achieved profit before tax (PBT) of RM130.2 million for FY2023 with a record revenue of RM1.0 billion, which were 24% and 19% respectively higher than that of the previous year.

The Group’s profit attributable to ordinary equity holders of the company in FY2023 shot up by 38% to RM82.8 million (FY2022: RM60.2 million).

With that, Paramount declared a second interim dividend of 4.0 sen for FY2023 (FY2022: 3.5 sen final dividend), which would be paid on 27 March 2024 to shareholders who are in the record of depositors on 13 March 2024.

For the benefit of shareholders, the Board of Directors of Paramount has resolved to adopt the practice of declaring second interim dividends, if any, as opposed to proposing final dividends, to enable shareholders to receive the dividend earlier.

Paramount Group CEO Jeffrey Chew said, “We are pleased with Paramount’s FY2023 results. Paramount achieved double-digit growth in revenue and PBT for the third year. We also touched RM1 billion in revenue for the first time. It was also our second consecutive year of achieving sales above RM1 billion.”

“The property division’s strong performance in 2023 coupled with the improvement in the financial performance of our other businesses showed the Group’s ability to thrive in an environment of moderate growth,” he said.

“Our property division achieved RM1.1 billion sales despite a 27% lower launched Gross Development Value (GDV) of RM886 million (FY2022:RM1.2 billion). The encouraging property sales achieved will contribute positively to the Group’s revenue as construction of these properties progresses.

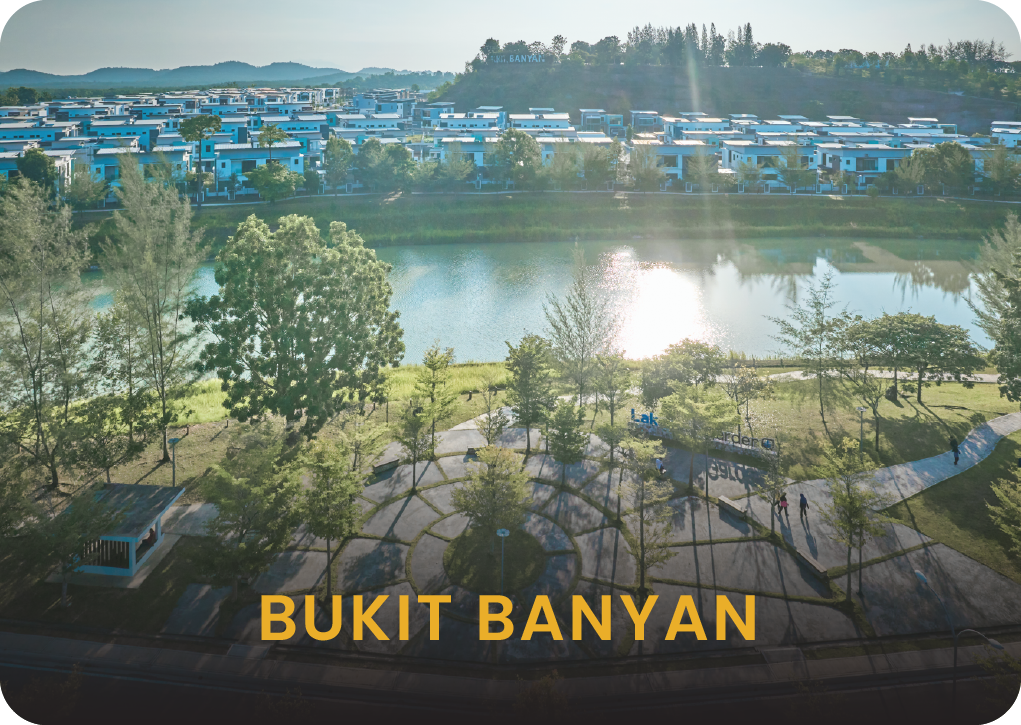

“The top three contributors to FY2023 sales were Sejati Lakeside 2 and The Atera developments in Selangor, and Utropolis Batu Kawan development in Penang,” he said.

Chew said the unchanged overnight policy rate at 3.0% coupled with the expected expansion of the Malaysian economy and improving labour market boded well for the property market in 2024.

He said Paramount Property would capitalise on its reputation as the People’s Developer and launch seven projects (including new phases of existing projects) in 2024 with a projected GDV of RM2.4 billion at its existing project locations in Penang, Kedah and the Klang Valley.

The three largest launches (in GDV) for FY2024 are The Ashwood (high rise condominiums, duplexes, and low-rise villas at the prestigious U-Thant enclave in Kuala Lumpur), Phase 2 of The Atera (transit-oriented development project in Petaling Jaya, situated next to the Asia Jaya Light Rail Transit Station) and a new phase of high rise residential development with commercial components at Utropolis Batu Kawan, Penang.

The Group’s unbilled sales as at 31 December 2023 stood at RM1.4 billion, and would provide some visibility on the Group’s cashflow in the near term.

Meanwhile, the coworking division scored its first full year profit with RM2.0 million PBT compared to a loss of RM0.6 million in FY2022. The coworking division also expanded its space by 37,000 sq ft in 4Q2023, comprising the expansion of its Tropicana Gardens space and a new space taken over at Ken TTDI at Taman Tun Dr Ismail, Kuala Lumpur.

“We are also bullish on the coworking business, having just opened another space in January 2024 and look forward to further expansion,” said Chew.

4Q2023 results

Group revenue was 26% higher at RM309.4 million while PBT and profit attributable to ordinary equity holders of the company for the 4Q2023 were RM38.4 million (4Q2022: RM33.0 million) and RM28.2 million (4Q2022: RM18.9 million), which were 16% and 49% higher than that of 4Q2022.

The property division’s 4Q2023 revenue was 26% higher at RM299.1 million (4Q2022: RM237.4 million) with the Sejati Lakeside 2 and Berkeley Uptown developments in Selangor, and Utropolis Batu Kawan development in Penang, as the top three revenue contributors. Despite the higher revenue, PBT for 4Q2023 was 7% lower at RM32.1 million compared to RM34.4 million recorded in 4Q2022 that was boosted by cost savings realised from certain completed projects.

The coworking division’s revenue for 4Q2023 was RM3.5 million, 25% higher than the same period last year mainly attributed to the higher revenue from The Starling and Naza Tower spaces coupled with the newly opened space at Ken TTDI. The coworking division recorded PBT of RM0.9 million in 4Q2023 compared to Loss Before Tax (LBT) of RM0.1 million in 4Q2022.

- Go to page 1

- Go to page 2

- Go to page 3

- Interim pages omitted …

- Go to page 16

- Go to Next Page »