Updates

PBMW Grand Lucky Draw

by crsupport

Bukit Banyan Hero Run attracts 1,800 aspiring heroes

by crsupport

PARAMOUNT PROPERTY IS THE MAIN SPONSOR

SUNGAI PETANI, 25 June 2024: The Bukit Banyan became the focal point for ‘hero-making’ once again on Saturday, 22 June 2024, with it hosting some 1,800 men, women and children who were participants of the Bukit Banyan Hero Run 2024. Bukit Banyan was the flag-off and finishing line for the run.

Each ‘hero’ went home with a finisher medal after completing either the 5km fun run or the 10km competitive run. This year saw a 50% increase in the number of participants compared to 2023.

Paramount Property, the developer of the 657-acre Bukit Banyan township, was the main sponsor as well as venue sponsor. The run was organised by the Kedah State Youth and Sports Department and Corporate Hero Century Sdn Bhd.

The run was flagged off by Chief of Mukim Merbok Hafizul Ahmad Salim, and representatives of the organisers and sponsors, Kedah State Youth Sports Director Noor Azma Binti Deris, Kedah State Youth Sports Department Deputy Director Mohd Hanaffi Bin A. Rahman, Corporate Hero Century Sdn Bhd Director Teoh Chia Chun and Paramount Property Northern Region CEO Wang Chong Hwa.

Wang said, “The Bukit Banyan Hero Run has once again brought together the community for a morning of healthy fun in this lovely town of Sungai Petani, while encouraging a sporting spirit among those who are more competitive.

“The Bukit Banyan Hero Run aligns with Paramount Property’s pillar to uplift communities as it promotes wellness and is an opportunity for Malaysians of ages and cultures to have fun together. Being flagged off at Bukit Banyan Hill Park, we also believe it promotes a love for Nature,” he said.

“We would like to congratulate the Kedah Youth and Sports Department and Corporate Hero Century Sdn Bhd for organising this wonderful event successfully for the second year in a row.”

The Bukit Banyan Hero Run offered two routes: 10km (competitive) and 5km (non-competitive). There were four categories for the 10km route: Men Open, Men Veteran, Women Open, and Women Veteran, that offered trophies and cash prizes from RM50 to RM500 for the top 10 in each category. The 5km category was open to all ages. A lucky draw prize of RM1,000 added to the excitement, offering participants who are not competitive a chance to also win big.

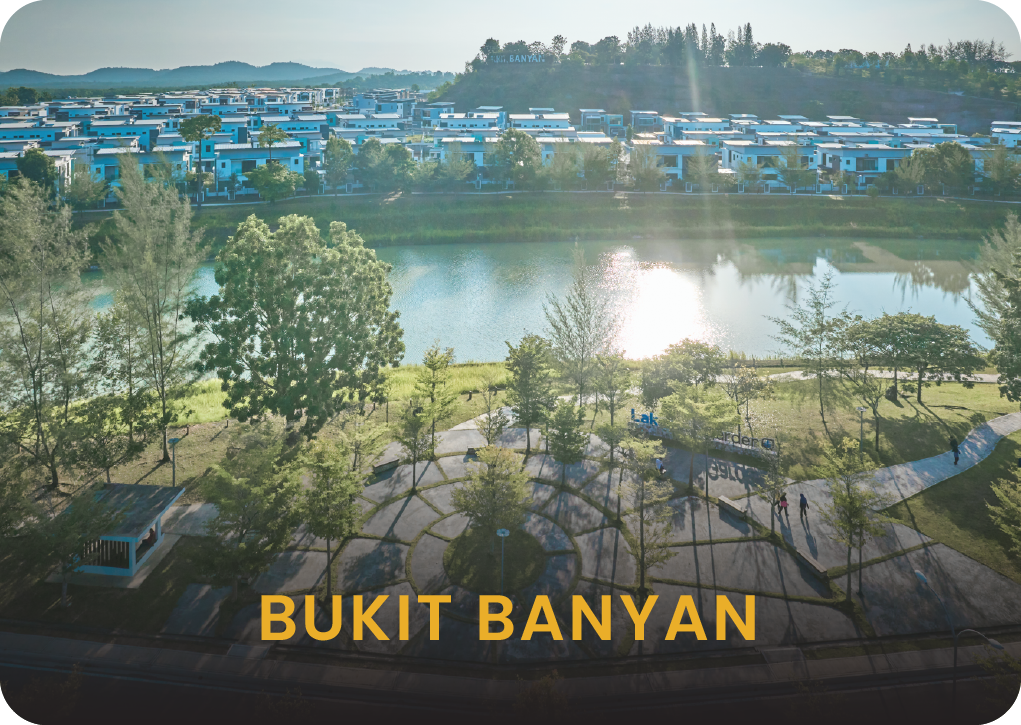

Bukit Banyan is Sungai Petani’s first gated-and-guarded hill park township development, offering a lifestyle that is ‘up close to nature’. The award-winning development comprises detached, semi-detached, double and single-storey terrace houses, townhouses, and shop offices. Bukit Banyan has received several awards for its family-centric designs and landscaping.

The Bukit Banyan Hill Park with its nine thematic landscaped parks is open to the public and is popular among Sungai Petani folk and those living in the northern region.

Paramount takes unconventional road for overseas ambition

by crsupport

By Esther Lee, The Edge (10 June 2024)

Paramount Corp Bhd (KL:PARAMON) is known as a steady and predictable counter, so much so that some would even call it “boring”. As such, the announcement last month that the property developer was buying 517 million shares, equivalent to a 21.5% strategic stake, in Ecoworld International Bhd (KL:EWINT) took the market by surprise and made investors sit up.

The stake acquired by Paramount’s wholly-owned subsidiary Flexsis Sdn Bhd was done through a direct business transaction with GLL EWI (HK) Ltd — a unit of GuocoLand Ltd that is controlled by Tan Sri Quek Leng Chan — at 33 sen a share, amounting to RM170.6 million. GuocoLand, in a separate announcement on the Singapore Stock Exchange, said it has disposed of its entire 27% stake in EWI. The buyer of the remaining 5.46% equity interest remains unknown.

Paramount group CEO Jeffrey Chew recounts that the group decided very quickly to snap up the 21.5% stake in EWI after getting wind that GuocoLand’s block was up for sale.

“The whole process took about four to six weeks, including the time to get financing in place … It is quite unprecedented in the history of Paramount and it sounds shocking and very spontaneous. It was actually a fast decision, but it’s something that has been brewing for probably the last six to seven years,” says Chew in a recent interview with The Edge.

Chew, who led OCBC Bank in Malaysia for six years before joining Paramount says more than the deal being fantastic investment opportunity for the group, it fits into what it wants to do — which is to diversify into property development overseas, and at the same time fulfilling the wishes of its late chairman Datuk Teo Chiang Quan.

He says the board is cognisant of the fact that the exponential growth of the property development business — averaging some 16% per annum over the last seven years — is not sustainable. Hence, it is making a conscious effort to slow down the growth of property development locally and seek diversification into other areas.

“We are preparing for what we are going to do beyond the 7% to 8% of growth in Malaysia for property development. We have two choices, which is to grow in property development outside of Malaysia, or we can grow outside of property development, going into other businesses in Malaysia.

“This opportunity [investment in EWI shares] came very timely to our approach of diversification and also redeploying our capital that is coming back from property development in Malaysia as we slow down the growth in property development locally,” explains Chew.

He also told the media in a briefing last week that Paramount is targeting 30% of its annual profit from overseas property projects by 2030, supported by its strategic investment in EWI.

Taking a back seat in ‘EWI bus’

The strategic stake in EWI would mean that Paramount is taking the unconventional path of diversifying into property development overseas through EWI. It is worth noting that EWI’s development projects are predominantly located in the UK. According to its 2023 annual report, EWI’s gross development value amounts to £4.6 billion in the UK and A$700 million in Australia.

Chew stresses that while Paramount will seek board representation so as to have a better insight as a shareholder into EWI’s operations and decision-making, it has no intention of taking over the wheel. Using the analogy of a bus, he enthusiastically describes how Paramount will be taking a “back seat” while allowing EWI to drive it in the direction and speed it intends to go.

“They [EWI management] still know how to drive the bus despite having some minor accidents along the way, but they are experienced. I am not going to go there and ask them if I can take over the steering wheel or hold onto the brakes,” he says, adding that Paramount’s role will be as a partner to support EWI and also to provide more equity financing when needed.

“We’re not going to take over the bus because we have no experience in the UK. Let’s be real,” Chew says, adding that by entering the UK property market through its shareholding in EWI, Paramount will have a chance to better understand and the UK market, which could potentially open a pathway for it to venture directly into development in developed markets in the future.

“Operating in a foreign land is challenging. We know it’s going to be challenging in the UK, but we will learn. We will try to get involved slightly at the operational level of the joint venture (JV) to learn and also identify the risks and then to measure the risks as well as provide feedback.

“So that will be the learning process in strengthening our organisation to be able to manage projects like that in developed markets,” says Chew.

Asked if Paramount would consider collaboration with EWI and in what form it would take, Chew emphasised that it is something both companies will have to be careful about so as to not cause brand confusion among the public.

“There are some potential collaborations, but we are trying to understand and see the potential impact on both parties. We don’t want people to confuse Paramount and EWI properties. Our property has different positioning and location from theirs,” he adds.

From the interview, it is clear the former banker has crunched the numbers and calculated the risks before bringing the deal to the Paramount board.

In fact, Chew confesses that he has been paying close attention to EWI for the past seven years, since its listing on Bursa Malaysia. While the odds have not been in EWI’s favour since its listing, Chew believes that the external factors that dragged EWI down in the past should not continue to weigh it down in the future

Critics say Paramount may be making a costly mistake with its investment in EWI, given the company’s past performance, which has failed to excite.

EWI suffered nine consecutive quarters of losses, resulting in net losses for the financial year ended Oct 31,2023 (FY2023) and FY2022, amounting to RM85.37 million and RM234.42 million respectively. However, it turned the corner in 1QFY2024, reporting a net profit of RM182,000 compared to a net loss of RM30.82 million a year ago.

Responding to the criticism, Chew says Paramount is essentially forking out some RM62 million for the stake, if the potential RM108 million return in dividends from EWI were taken into account.

EWI has committed to clear its inventories worth RM850 million and to distribute its excess cash as dividends for FY2024.

However, for Chew it is more than the cash value that he sees in EWI, he believes in the prospects of the property developer going forward.

He believes that EWI was largely impacted by Brexit, Covid-19 and subsequently high interest rates, rather than poor management.

“I believe the UK government would know how to deal with the implications from Brexit by now, they cannot do worse. So that’s a positive for EWI. As for Covid, if there’s no Covid, it’s another positive for the group.

“In terms of interest rates, it is hovering at 5% to 6% in the UK, making mortgages very expensive. But if it stays at the same level for the next five years, it’s neutral for EWI but if it goes down, then it’s another positive factor for the group,” he says.

Would Paramount invest further in EWI in the future if the latter needs funds?

“We have capital coming in and with us slowing down our growth rate locally, I will be very eager to pump the capital into EWI. We really believe that with the right strategy, right leadership and right direction, a company can go forward,” says Chew, who believes that EWI might need some capital somewhere in 2027 or 2028 for land banking.

JV for overseas development for now

Since the disposal of its controlling stake in the tertiary education business back in 2019, Paramount has been looking for other avenues to diversify its income stream to make up for the gap from the education business. It has ventured into co-working spaces, dipped its hand in digital enterprises such as peer-to-peer financing and online learning platforms while steadily building its property development portfolio locally.

Nevertheless, diversifying into property development overseas has continued to challenge the group. It has tried unsuccessfully to break into the Australian property development market.

Outside of Malaysia, it currently has only one ongoing 49%-equity venture development in Bangkok, Thailand, in which it invested RM24.6 million.

But the group is not letting go of its ambition and it is still on the lookout for opportunities overseas.

“We are not buying land overseas directly but we will probably look at joint ventures. I don’t think we are ready to go into the market overseas and buy land on our own for now. Over time, we might. But I think at this point, we’re not ready,” shares Chew.

Paramount’s philosophy is not to hoard land, but rather to focus on churning its projects quickly in order to keep its return on equity high.

Its projects are concentrated in the northern and central Peninsular Malaysia, with 10 ongoing developments currently.

Asked about the outlook for the group in 2024, Chew says he is “cautiously optimistic”, adding that the is hopeful for a pickup in activity in the second half of 2024.

“I believe that 2024 is also part of the continuous recovery and also the new government, new so-called plan for energy transition, economy transformation and all that will take place. It has been a little bit slower than what I expected. But I hope the second half will improve,” he says.

For 1QFY2024, Paramount recorded a net profit of RM7.7 million, down 33.4% from a year ago. Revenue was down 11.2% at RM172.61 million from the previous year.

In the past one year, Paramount’s counter has gained 38.2%, closing at RM1.12 per share last Thursday, giving it a market capitalisation of RM697 million.

Cover Story: Paramount Property to launch Uptown Residences 2 This Month

by crsupport

This article first appeared in City & Country, The Edge Malaysia Weekly on June 10, 2024 – June 16, 2024

The royal city of Klang has gradually transformed over the years. In addition to excellent seafood and bak kut teh, it has also become a popular place for property development.

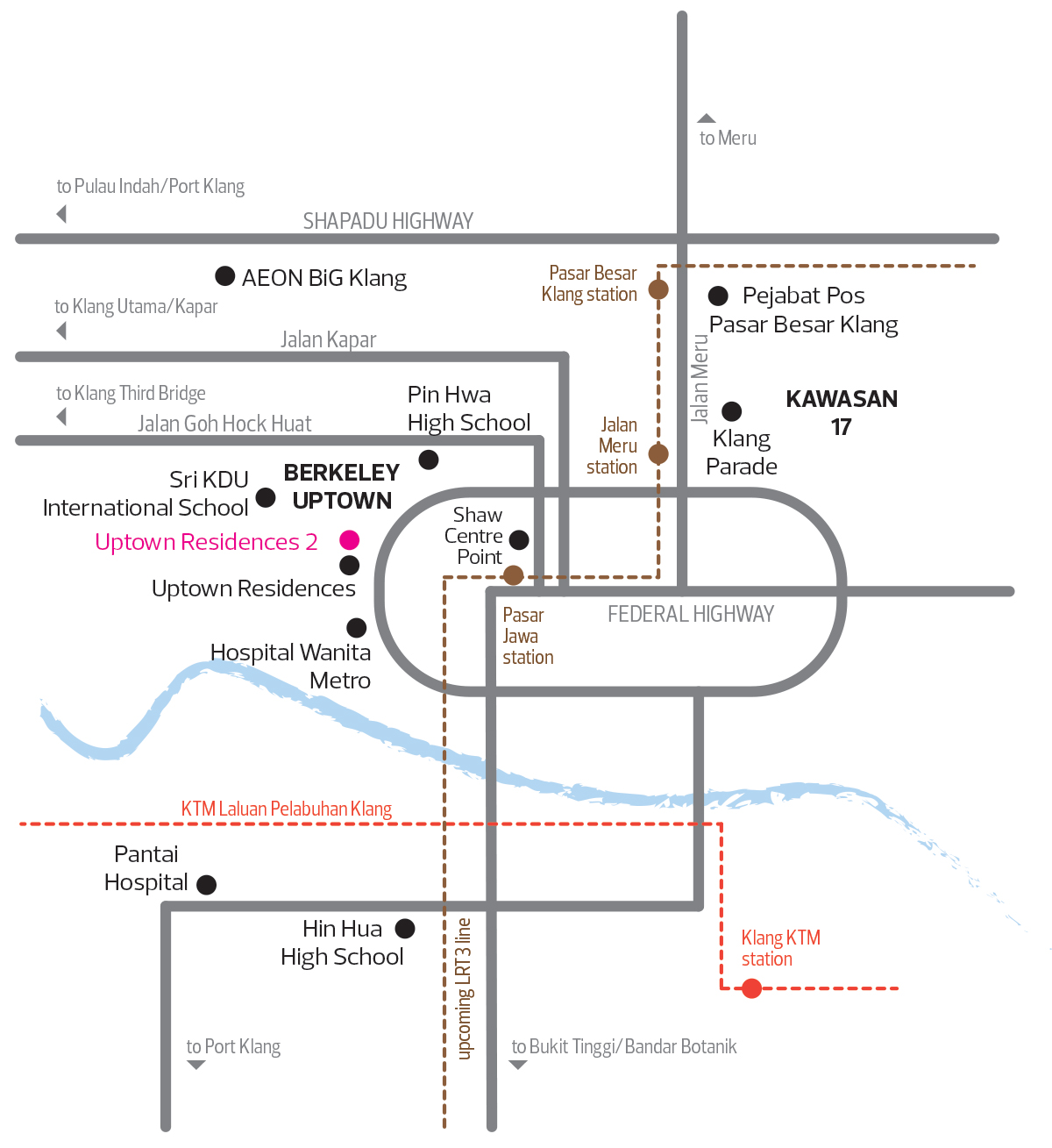

This month, Paramount Property Development Sdn Bhd is introducing Uptown Residences 2, a residential offering with an intergenerational living concept, at its Berkeley Uptown development in the city.

Berkeley Uptown is a RM1.2 billion commercial project that sits on 33.12 acres of freehold land on Jalan Goh Hock Huat.

Paramount Property’s property division CEO Chee Siew Pin, who grew up in Klang, tells City & Country how familial ties are still very important for those living here.

“I roughly know of the needs of the people here [in Klang] and so I planned what is best for the community,” he says, adding that the entire project is designed to provide an intergenerational lifestyle where families can live close to each other.

“I want to bring everyone into one place where three generations can live together for a more sustainable living situation.”

According to Chee, “The land [where Berkeley Uptown is located] used to be an old shoe factory, Fung Keong Rubber Manufacturing Mill, which was established in 1939 on Jalan Goh Hock Huat. In 2011, Paramount submitted a bid to purchase this 11.7ha (about 29 acres) land and won. [Envisioning] a bigger development, we expanded the land size by acquiring an additional 1.6ha [across from the factory site] on Jalan Goh Hock Huat and adjacent to Klang’s central business district on the west.”

Both of the land acquisitions were completed in 2011 at a cost of RM110 million, he adds.

Berkeley Uptown has five sections. One portion, measuring 5.23 acres, is taken up by Sri KDU International School, which has been in operation since November 2020. It is the first Microsoft flagship school in Southeast Asia.

On another portion sits Uptown Residences. Launched in 2019 and fully sold, the project is on 5.18 acres and offers 736 units. It has a gross development value (GDV) of RM369.09 million and vacant possession of the project is expected to be delivered this year.

Two other portions of Berkeley Uptown have been set aside for future commercial development while the last section of land is for Uptown Residences 2, which is slated for launch by the end of June, says Chee.

Catering for intergenerational living

Sitting on 7.37 acres, Uptown Residences 2 will have a GDV of RM628.64 million. It will offer 1,086 units spread out across a low-rise building and two towers.

The 6-storey low-rise structure, called Parkfront Villas, is divided into two wings called Block A and Block B. The ground level will have a 10,000 sq ft community space while the 35 residential units (Block A: 15 units; Block B: 20 units) are in the remaining five levels. The low-rise building’s rooftop is the development’s recreational podium deck.

Each unit in the low-rise building will have a built-up of 1,556 sq ft, with four bedrooms, four bathrooms and one utility room. Each unit will also have four parking spaces directly in front of it, allowing the homeowner to park cars like on landed property.

At the launch, units in Block A will be available for purchase, at prices starting from RM908,000. Units in Block B will be released at a later date.

As for the towers, one will be 32 storeys with two wings called Block C1 and Block C2. Block C1 will have 252 units with built-ups ranging from 1,000 to 1,350 sq ft, while Block C2 will have 365 units sized from 910 to 1,350 sq ft. The layouts will be 3- to 4-bedrooms with 2- to 3-bathrooms. Each unit will come with two to four parking bays.

The second tower, Block D, will stand at 37 storeys. There will be 434 units with built-ups ranging from 910 to 1,350 sq ft. The layouts will be 3- to 4-bedrooms with 2- to 3-bathrooms and the units will come with two to four parking spaces each.

At the launch, only units in Block C1 will be available, at prices starting from RM573,800. Those at Block C2 and Block D will be released later.

“The units are provided with smart home systems, like smart door locks, switches, lights and fans. We have a hub in case the owner wants to install other smart devices,” says Chee.

In addition, they will come with wet kitchen cabinets, kitchen hoods and hobs, shower screens with glass doors in the master bedrooms, fixed shower screens for the other bathrooms, towel rails for common bathrooms and water heaters.

As the development is focused on intergenerational living, certain design elements have been included to cater to the elderly. For example, common areas will have walkways that are wheelchair and baby pram accessible, and lifts will have buttons accessible from wheelchairs.

Units will have doorways and hallways wide enough for wheelchairs, lever-style door handles instead of door knobs, non-slip flooring materials in the bathrooms, towel rails that can double as handrails, foldable shower seats in common bathrooms, and switches and outlets placed at 1.2m (about 4ft) high.

According to Chee, Blocks B, C2 and D will be released to the market depending on demand and the sales performance of the launched units. He highlights, however, that the entire Uptown Residences 2 will be completed by 2028.

Fostering community spirit

Uptown Residences 2 is designed to foster closer ties within families and the wider community, says Chee. “Uptown Residences 2 is where different generations can flourish together in a secure haven that has a verdant central park, a recreational podium deck, a private rooftop garden that’s the first of its kind in Klang, 2.9 acres of lush landscapes and 40 lifestyle facilities for all ages.”

The one-acre central park is divided into various sections catering to different age groups. There is a reflexology path, chill-out island seats, pet play park, playground, an outdoor gym station, and a cycling and jogging track.

“There are open spaces with lush greenscapes for children to play and pet-play equipment in the park. Parents and grandparents can enjoy a relaxing time at the chill-out island seats or enjoy foot reflexology while the children play to their hearts’ content,” says Chee.

Additionally, and unique to the development, is the 10,000 sq ft community social space that will take up the ground level of the 6-storey low-rise building. This space will be divided into 11 lots.

“The private space is envisioned to be a community centre where residents can come together to enjoy shared activities such as lively games of Chinese chess, a farmers’ market, a weekend bazaar, pet grooming classes and more. This setting is to forge a stronger community bond among the residents,” Chee explains.

Additionally, Paramount plans to invite traditional Chinese medicine (TCM) practitioners to set up shop here, as well as organise conventional health checks on a periodic basis. There are plans to also invite a child enrichment centre and a convenience store to open here. Once the right tenants and services are in place, Paramount will hand over the operations to the management corporation (MC) to manage.

“The community social space’s internal wall is hackable if there is a bigger space requirement by the operator,” he says.

Also, the rents charged will be affordable and what is collected will be handed over to the MC, when it is formed, to offset the cost of the operational services of the apartments so as to keep costs low and to ensure the development is well maintained.

To ensure that the development is well taken care of, the maintenance fee inclusive of the sinking fund is 36 sen psf.

Complementing the central park and the community social space will be the recreational podium deck atop the low-rise building and the lifestyle rooftop garden on top of Block D.

The recreational podium deck will feature a swimming pool, a herb garden, lounge, barbeque area, relaxation nook, yoga deck, reflexology path, trampoline area, hammock alcove, multipurpose hall, gym, half basketball court and meditation lounge.

The lifestyle rooftop garden will feature a sky bar, barbeque terrace, meditation lawn, sky lounge, viewing pavilion and chill-out net.

To ensure that residents can use all these facilities with peace of mind, the development will be gated and guarded with 24/7 surveillance and security patrols, along with a secure card access system to the parking lot, lobby and lift area.

Chee highlights that the development is designed to include various sustainable and eco-friendly elements, and aims for GreenRE Silver certification.

Environmental, social and governance compliance is high on the developer’s list of priorities, with all components being met through careful planning in the design of the project.

While the internal needs of the residents are catered to, outside of Uptown Residences 2 are numerous amenities, highways and forms of public transport.

Nearby shopping centres include Shaw Centrepoint, Klang Parade, AEON Big Klang, Centro Mall and AEON Bukit Raja. Also close to the development are banks such as Public Bank, Hong Leong Bank and Maybank, markets like Pasar Malam Klang, Pasar Jawa and Pasar Besar Klang Meru, and public services such as a fire and rescue station, Pos Malaysia, a police station, a Syabas office and Majlis Perbandaran Klang.

As for schools and institutions of higher learning, there are SMK Tinggi Klang, SK (1) and (2) Jalan Meru, SJK (C) Kong Hoe, SMK Sultan Abdul Samad, Pin Hwa High School, Kwang Hua Private High School, Acmar International School, Regent International School, Peninsular College City Campus, Royal Oxford University and Universiti Teknologi Mara.

Medical facilities include Hospital Wanita Metro Klang, Mahsa Healthcare Centre, Sri Kota Specialist Medical Centre, KPJ Klang Specialist Hospital, JMC Specialist Medical Centre, Tengku Ampuan Rahimah Hospital and Pantai Hospital Klang.

Access to Berkeley Uptown is via the Federal Highway, Shapadu Highway, NKVE, West Coast Expressway, Kesas, Pulau Indah Highway and Elite Highway. Public transport nearby include the LRT3 stations of Pasar Jawa and Meru, to be completed in 2025. Chee highlights that this line is linked to an interchange at Glenmarie station, which will take passengers to Kuala Lumpur City Centre. In addition, the KTM Klang station is 1.3km away.

On Paramount Property’s local, international fronts

Berkeley Uptown is just one of the many projects Paramount Property is undertaking. Ongoing developments include the RM780 million The Ashwood in Ampang, the RM600 million The Atera in Petaling Jaya, the RM217 million Greenwoods in Sepang, the RM185 million Sejati Residences Phase 4 in Cyberjaya, and the RM156 million Bukit Banyan in Kedah.

As for upcoming property launches, there is the RM295 million Utropolis Batu Kawan in Penang in 3Q2024.

On future developments, Chee says, “We are on the lookout to expand our property development footprint locally and internationally as part of our strategic plan (2020-2025) to diversify our income base.

“Locally, although we prefer to expand in areas where our brands have been established, namely Selangor, Kuala Lumpur, Penang and Kedah, we are open to other regions that have strong returns potential.

“Internationally, in 2020, we invested in an equity venture in Thailand to build Na Reva Charoennakhon, a 29-storey condominium in Bangkok that was completed recently. Then, in May this year, we sped up our expansion by acquiring a strategic stake in Eco World International (KL:EWINT), which has projects in London, Melbourne and Sydney,” he adds.

Paramount Homebound Happiness

by crsupport

- Go to page 1

- Go to page 2

- Go to page 3

- Interim pages omitted …

- Go to page 40

- Go to Next Page »