Uncategorized

CNY Open House @ Paramount Property Gallery Greenwoods Salak Perdana

Transformation Ahead

KUALA LUMPUR (Jan 22): Established more than five decades ago, Paramount Corp Bhd is known for its core businesses of property development and education, particularly Kolej Damansara Utama. It has since disposed of a majority stake in its tertiary education business in 2019, and bowed out of the pre-tertiary education business last year.

In recent years, Paramount Corp has also ventured into the workspace solutions business (with Co-labs Coworking and Scalable Malaysia) and the hospitality business with Mercure Kuala Lumpur Glenmarie at Utropolis Glenmarie in Shah Alam, Selangor.

The group is now looking at opportunities in the digital realm, especially, to take the company to the next level. Deputy group CEO and executive director Benjamin Teo says that as the company needs to look at parabolic growth, the best way is to look into other businesses such as digital ones.

In the same issue, we look into LBS Bina’s plans for 2023, and speak to KGV International Property Consultants on how the housing market in Johor Baru performed in 3Q2022. We also feature the just-launched CBRE|WTW’s Market Outlook 2023 report.

Paramount Property | StarProperty Real Estate Developer Awards 2022

Understanding the needs of the people, the People’s Developer Paramount Property has carved out more spaces and meeting points for the community.” – TheStar, 2022

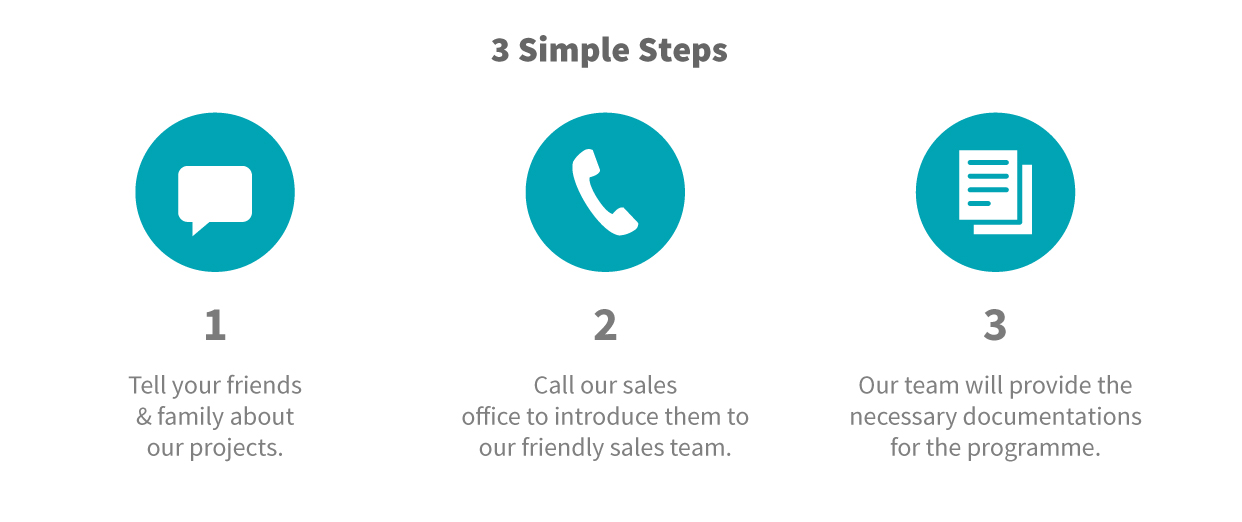

Cash Reward for Introducing Buyer Test

As a member of Paramount Property Circle, earn cash when you introduce our properties to your family and friends!*

Klang Valley

Kedah

Penang

*Applicable to Paramount Property Circle members only. Terms and conditions apply.

Paramount Maintains Positive Outlook from Improved Performance

PARAMOUNT Corporation Berhad (Paramount) posted RM5.024 million net profit for the quarter of the year from RM2.297 million a year ago.

Its revenue increased to RM168.1 million as compared to RM151.8 million posted in 1Q21.

Its property division for 1Q22 revenue was RM163.9 million, a 10% increase compared to that of the same period last year of RM149.6 million, which was driven by ongoing development projects such as ATWATER in Petaling Jaya, Sejati Lakeside in Cyberjaya, and Bukit Banyan in Sungai Petani.

On the back of the higher revenue coupled with the realisation of cost savings from certain completed and near-completion projects, the coworking division recorded a lower loss before tax (LBT) of RM0.3 million compared to a LBT of RM1.1 million in 1Q2021.

Paramount Group CEO Jeffrey Chew said, “The group has delivered an overall improvement in revenue and earnings as the country moves into endemicity.”

“The improved financial performance in 1Q2022 compared to the same period last year was mainly due to a higher profit contribution from the property division with fewer operational disruptions this quarter compared with the corresponding period last year.”

Six projects (including new phases of existing projects) are targeted for launch throughout the year with an estimated gross development value of RM1.3 billion.

Among the new projects lined up are the Arinna Kemuning Utama smart homes in Shah Alam; The Atera, a transit-oriented development project in Petaling Jaya situated next to the Asia Jaya Light Rail Transit Station; and Sejati Lakeside 2 landed homes in Cyberjaya.

“Despite the recent OPR hike of 25 basis points, the prevailing low-interest environment remains conducive for property demand. Malaysians with financial means will still look to property as a hedge against inflation.”

“With rising prices of properties, especially in established urban areas where land is getting scarce, coupled with the increase in building material costs, there are opportunities for capital gains in the long term,” said Chew.

“That said, we are mindful that the recovery of the property sector could be dampened by uncertainties related to the COVID-19 virus, any aggressive interest rate hike, the rising cost of living and lower spending power,” he concluded.