PARAMOUNT PROPERTY IS THE MAIN SPONSOR

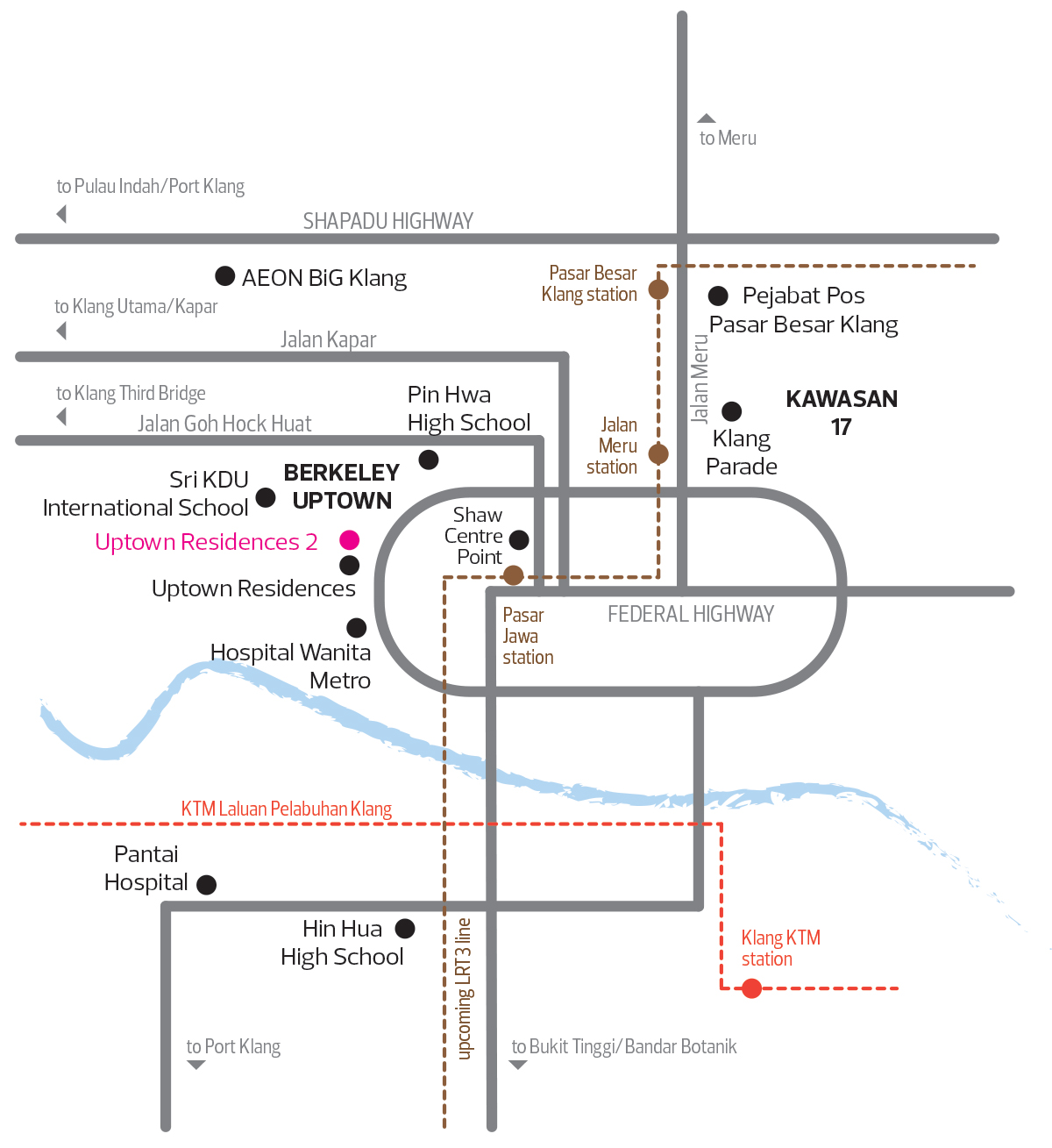

SUNGAI PETANI, 25 June 2024: The Bukit Banyan became the focal point for ‘hero-making’ once again on Saturday, 22 June 2024, with it hosting some 1,800 men, women and children who were participants of the Bukit Banyan Hero Run 2024. Bukit Banyan was the flag-off and finishing line for the run.

Each ‘hero’ went home with a finisher medal after completing either the 5km fun run or the 10km competitive run. This year saw a 50% increase in the number of participants compared to 2023.

Paramount Property, the developer of the 657-acre Bukit Banyan township, was the main sponsor as well as venue sponsor. The run was organised by the Kedah State Youth and Sports Department and Corporate Hero Century Sdn Bhd.

The run was flagged off by Chief of Mukim Merbok Hafizul Ahmad Salim, and representatives of the organisers and sponsors, Kedah State Youth Sports Director Noor Azma Binti Deris, Kedah State Youth Sports Department Deputy Director Mohd Hanaffi Bin A. Rahman, Corporate Hero Century Sdn Bhd Director Teoh Chia Chun and Paramount Property Northern Region CEO Wang Chong Hwa.

Wang said, “The Bukit Banyan Hero Run has once again brought together the community for a morning of healthy fun in this lovely town of Sungai Petani, while encouraging a sporting spirit among those who are more competitive.

“The Bukit Banyan Hero Run aligns with Paramount Property’s pillar to uplift communities as it promotes wellness and is an opportunity for Malaysians of ages and cultures to have fun together. Being flagged off at Bukit Banyan Hill Park, we also believe it promotes a love for Nature,” he said.

“We would like to congratulate the Kedah Youth and Sports Department and Corporate Hero Century Sdn Bhd for organising this wonderful event successfully for the second year in a row.”

The Bukit Banyan Hero Run offered two routes: 10km (competitive) and 5km (non-competitive). There were four categories for the 10km route: Men Open, Men Veteran, Women Open, and Women Veteran, that offered trophies and cash prizes from RM50 to RM500 for the top 10 in each category. The 5km category was open to all ages. A lucky draw prize of RM1,000 added to the excitement, offering participants who are not competitive a chance to also win big.

Bukit Banyan is Sungai Petani’s first gated-and-guarded hill park township development, offering a lifestyle that is ‘up close to nature’. The award-winning development comprises detached, semi-detached, double and single-storey terrace houses, townhouses, and shop offices. Bukit Banyan has received several awards for its family-centric designs and landscaping.

The Bukit Banyan Hill Park with its nine thematic landscaped parks is open to the public and is popular among Sungai Petani folk and those living in the northern region.